The Top 7 Best Nurse Malpractice Insurance Companies in 2025 Affordable Coverage & Premium Comparison for RNs and LPNs. The top providers of professional liability insurance for nurses in 2025 include NSO, MedPro Group, ProAssurance, The Doctors Company, Coverys, Liberty Mutual, and Nationwide Insurance. The best option depends on individual coverage needs and price, as premiums vary by specialty, location, and risk profile.

What are Top 7 Best Nurse Malpractice Insurance Companies in 2025 Affordable Coverage & Premium Comparison for RNs and LPNs

Introduction

Are you an RN or LPN practicing with out malpractice coverage, assuming your employer`s insurance protects you? Here’s the cruel reality: clinic legal responsibility guidelines defend the facility, now no longer person nurses. In 2025, the common malpractice lawsuit agreement in opposition to nurses degrees from $250,000 to $500,000—and with out your very own insurance, you are for my part accountable for criminal fees, settlements, and license protection expenses that might bankrupt you.

Whether you are a new grad, tour nurse, or skilled ICU specialist, wearing person malpractice coverage is not elective anymore—it is profession safety that expenses much less than your month-to-month espresso price range even as safeguarding your nursing license, private assets, and expert reputation.

Quick Snapshot: What to Expect from Top Nurse Malpractice Insurance in 2025

Average annual charges for RNs variety from $one hundred to $three hundred for trendy $1 million in line with incident and $three million combination insurance. LPNs and LVNs generally pay much less, with costs between $eighty five and $2 hundred yearly because of decrease hazard profiles. The enterprise trendy insurance restrict is $1M/$3M, aleven though a few organizations provide better limits up to $2M/$6M for superior exercise nurses.

Legal protection expenses are blanketed similarly to coverage limits with maximum top-tier carriers. Premium price alternatives consist of month-to-month installments of $10 to $25 or discounted annual payments. License protection insurance is protected with fine guidelines, protective you at some point of State Board of Nursing investigations. Most expert legal responsibility guidelines convey 0 deductibles, and earlier acts insurance is to be had for nurses involved approximately claims from preceding employment.

What is Nurse Malpractice Insurance?

Nurse malpractice coverage, additionally referred to as expert legal responsibility coverage, is specialized insurance that protects registered nurses, certified sensible nurses, and nurse practitioners from monetary loss while accused of negligence, errors, or omissions in affected person care. Unlike your employer`s widespread legal responsibility coverage, man or woman malpractice coverage covers you personally, purchasing legal professional fees, courtroom docket costs, agreement amounts, and State Board of Nursing protection in case your license is challenged.

Think of it as monetary armor to your nursing career. If a affected person claims you administered the incorrect medication, neglected essential symptoms, or brought about harm throughout a procedure, your malpractice coverage covers prison representation, which costs $three hundred to $500 in keeping with our without coverage, and protects your private savings, home, and destiny profits from lawsuits.

Understanding the Two Types of Coverage

Occurrence-primarily based totally insurance protects you for incidents that manifest throughout your coverage period, even though the declare is filed years once you cancel the coverage. This kind is extra high-priced however gives complete safety that extends past your lively employment. Claims-made insurance, on the alternative hand, covers incidents and claims filed even as your coverage is lively. This alternative is extra low-cost and maximum not unusual place for body of workers nurses however requires “tail insurance” if you turn jobs or retire to guard in opposition to late-filed claims.

Why Malpractice Insurance Matters for Your Nursing Career

Legal and Financial Protection

Your hospital`s malpractice coverage has one goal: defend the hospital. If a lawsuit names each you and your employer, the facility’s criminal group might also additionally prioritize the institution’s pastimes over yours, or worse, argue you acted outdoor coverage to shift liability. With person insurance, you get your personal legal professional who works totally for you.

Consider this real-international scenario: An ER nurse administered medicine in step with health practitioner order, however the dosage calculation become incorrect. The hospital’s attorney argued the nurse ought to have wondered the order. Without private insurance, the nurse paid $87,000 in criminal charges earlier than the case becomes dismissed. This is precisely why person insurance is essential, irrespective of your employer’s coverage.

Career Advantages of Having Coverage

State Board protection insurance way that if a affected person grievance triggers a Board of Nursing investigation, your coverage covers criminal illustration in the course of hearings, that could shop your license. Travel nurses, in step with Diem staff, and company nurses want transportable insurance that follows them throughout assignments and nation lines.

Most guidelines make bigger to volunteer nursing sports like scientific missions and network clinics, permitting you to provide lower back without worry. License safety insurance consists of illustration for license suspension or revocation proceedings that could derail your whole career. Perhaps maximum importantly, having insurance presents peace of thoughts that helps you to cognizance on affected person care rather than worry of frivolous lawsuits.

Financial Benefits

At $a hundred to $three hundred annually, malpractice coverage prices much less than one shift`s pay as an RN, which commonly levels from $2 hundred to $400? It’s additionally much less high priced than month-to-month automobile coverage rates or annual CEU route fees. The funding protects property you’ve got spent years building, inclusive of your own home equity, retirement financial savings, and destiny incomes potential.

As a brought benefit, malpractice rates are tax-deductible for nurses who itemize deductions or paintings as unbiased contractors. This method the real out-of-pocket value is even decrease whilst you element with inside the tax financial savings at submitting time.

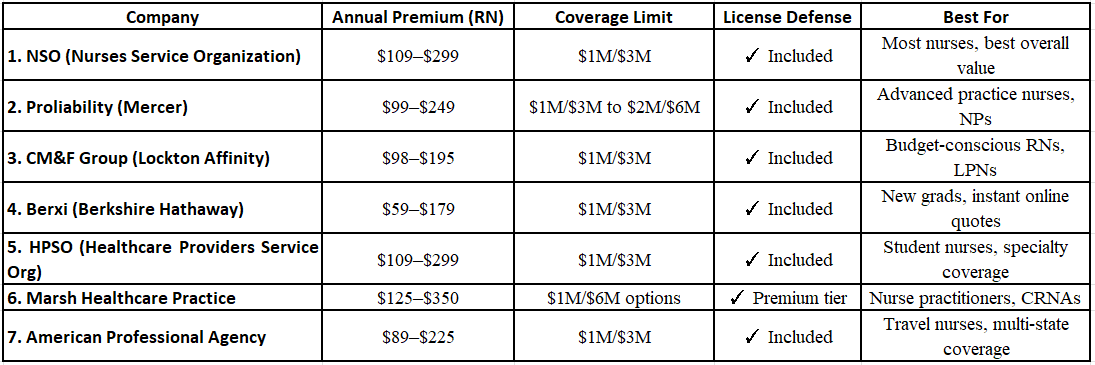

Top 7 Nurse Malpractice Insurance Companies Compared — 2025 Rankings

| Company | Annual Premium (RN) | Coverage Limit | License Defense | Best For |

| 1. NSO (Nurses Service Organization) | $109–$299 | $1M/$3M | ✓ Included | Most nurses, best overall value |

| 2. Proliability (Mercer) | $99–$249 | $1M/$3M to $2M/$6M | ✓ Included | Advanced practice nurses, NPs |

| 3. CM&F Group (Lockton Affinity) | $98–$195 | $1M/$3M | ✓ Included | Budget-conscious RNs, LPNs |

| 4. Berxi (Berkshire Hathaway) | $59–$179 | $1M/$3M | ✓ Included | New grads, instant online quotes |

| 5. HPSO (Healthcare Providers Service Org) | $109–$299 | $1M/$3M | ✓ Included | Student nurses, specialty coverage |

| 6. Marsh Healthcare Practice | $125–$350 | $1M/$6M options | ✓ Premium tier | Nurse practitioners, CRNAs |

| 7. American Professional Agency | $89–$225 | $1M/$3M | ✓ Included | Travel nurses, multi-state coverage |

Comprehensive Company Breakdown

1. NSO (Nurses Service Organization) — Best Overall for RNs and LPNs

NSO stands as the biggest nurse malpractice insurer with inside the United States, having blanketed over 600,000 nurses on account that 1976. They`re recommended via way of means of extra than 30 nation nursing institutions and provide each occurrence-primarily based totally and claims-made regulations with 0 deductibles. Their popularity for truthful claims managing and complete insurance makes them the gold trendy in nursing expert legal responsibility insurance.

This organization is right for team of workers nurses, tour nurses, and LPNs searching for complete insurance with verified claims support. Their large revel in manner they recognize the particular dangers nurses face throughout all specialties and exercise settings.

Premium and Coverage Details

NSO stands as the most important nurse malpractice insurer with inside the United States, having blanketed over 600,000 nurses seeing that 1976. They`re recommended via way of means of greater than 30 nation nursing institutions and provide each occurrence-primarily based totally and claims-made guidelines with 0 deductibles. Their popularity for honest claims managing and complete insurance makes them the gold fashionable in nursing expert legal responsibility insurance.

This corporation is right for workforce nurses, journey nurses, and LPNs looking for complete insurance with established claims support. Their substantial revel in method they apprehend the precise dangers nurses face throughout all specialties and exercise settings.

RN insurance begins off evolved at just $109 in step with year for a $1M/$3M claims-made coverage, at the same time as LPN insurance starts off evolved at $eighty five yearly for the identical insurance limits. ANA participants get hold of a 10% bargain on premiums. The coverage consists of loose danger control CEUs that matter towards your license renewal requirements, and that they keep a 24/7 claims reporting hotline so you are in no way without support.

NSO guidelines cowl HIPAA violations and privateness breach claims, which might be more and more not unusual place in contemporary digital fitness document environment. They encompass attack insurance for affected person or own circle of relatives altercations, and lamentably important safety in cutting-edge healthcare settings. Legal illustration for State Board hearings is included, and there may be no ready duration so you’re insurance begins off evolved right now upon approval.

You can observe on-line at nso.com and get hold of immediately prices in approximately 5 minutes. The software technique is simple and would not require substantial clinical records or invasive questions on your exercise.

2. Pro-liability (Mercer) — Best for Advanced Practice Nurses and Nurse Practitioners

Pro-liability, sponsored with the aid of using coverage massive Mercer, focuses on insurance for superior exercise registered nurses, such as nurse practitioners, medical nurse specialists, and nurse anesthetists. They provide better insurance limits and apprehend the expanded legal responsibility publicity that incorporates prescriptive authority and impartial exercise.

This insurer is right for NPs, CNMs, CRNAs, and CNSs who want more desirable insurance limits and specialized danger control assets tailor-made to superior exercise. If you`re practicing independently or going for walks your personal clinic, Proliability affords the complete safety essential for self-sufficient exercise.

Premium and Coverage Details

Annual charges for nurse practitioners variety from $ninety nine to $249 relying on specialty, exercise setting, and state. Coverage limits increase from the standard $1M/$3M up to $2M/$6M for the ones requiring more desirable safety. They provide each incidence and claims-made regulations with bendy price plans.

Pro-liability consists of cyber legal responsibility insurance for records breaches at no extra cost that is vital for NPs retaining their personal digital fitness records. Their regulations cowl telehealth services, a unexpectedly developing exercise vicinity that many insurers exclude. License protection insurance extends to DEA license safety for prescribers, and that they offer get entry to to a 24/7 danger control hotline staffed with the aid of using nurses and lawyers who apprehend superior exercise issues.

The organization gives a reduction for claims-loose years, profitable secure exercise with top class reductions. You can achieve rates via impartial coverage marketers or without delay via Mercer’s healthcare exercise department at Proliability.com.

3. CM&F Group (Lock ton Affinity) — Best Budget Option for Cost-Conscious Nurses

CM&F Group, administered via Lock ton Affinity, has supplied low-cost nurse malpractice coverage in view that 1980. They consciousness on maintaining rates low without sacrificing vital insurance, making them famous amongst new graduates and nurses operating part-time who want fine safety on a restricted budget.

This service is ideal for budget-aware RNs and LPNs who need complete insurance without top class prices, in addition to part-time and consistent with Diem nurses who want complete safety in spite of restricted paintings hours.

Premium and Coverage Details

RN insurance begins off evolved at an impressively low $ninety eight yearly for $1M/$3M claims-made insurance, whilst LPN guidelines start at just $seventy nine consistent with year. Despite the low cost, CM&F doesn`t skimp on essentials. License protection insurance is included, and that they cowl appropriate Samaritan acts while you offer emergency care out of doors your workplace.

Their guidelines enlarge to volunteer nursing sports and provide occurrence-primarily based totally alternatives for nurses who need long-time period safety. Monthly price plans begin at just $8.50 for LPNs, making insurance on hand even on a good budget. CM&F consists of attack and battery insurance and affords criminal illustration for Board of Nursing complaints.

The utility manner is easy and may be finished on line at cmfgroup.com. They’re especially famous with nurses in states like California, Texas, and Florida wherein malpractice worries are highest.

4. Berxi (Berkshire Hathaway) — Best for New Grads and Instant Online Coverage

Berxi brings the monetary energy of Warren Buffett`s Berkshire Hathaway to nurse malpractice coverage with a modern, tech-ahead approach. Their absolutely virtual platform offers immediate quotes, instant insurance, and paperless coverage control via a user-pleasant cell app.

This corporation is right for brand new graduates looking for low-cost first-time insurance, tech-savvy nurses who choose virtual coverage control, and anybody wanting instant insurance without expecting approval.

Premium and Coverage Details

Berxi gives a number of the maximum aggressive charges with inside the industry, with RN insurance beginning at just $fifty nine yearly for $1M/$3M limits. New graduates get hold of unique pricing that acknowledges their decrease hazard profile for the duration of the primary year of exercise. Despite the low cost, insurance is complete and subsidized via way of means of one of the world’s maximum financially solid coverage companies.

The immediate on line quote device offers correct pricing in below minutes, and insurance starts at once upon buy and not using a clinical underwriting or exercise assessment required. Their cell app permits you to get entry to your coverage card, record claims, and manipulate your coverage out of your phone. License protection insurance is included, and that they provide bendy price alternatives consisting of month-to-month billing as low as $5.

Berxi offers hazard control sources consisting of loose webinars and articles written via way of means of nurse attorneys. Their claims system is streamlined and virtual, lowering the strain of reporting incidents. You can get a quote and buy insurance immediately at berxi.com.

5. HPSO (Healthcare Providers Service Organization) — Best for Student Nurses and Specialty Coverage

HPSO has been protective nurses due to the fact that 1982 and is a sister business enterprise to NSO, sharing the equal exceptional popularity for claims dealing with and consumer service. They concentrate on insurance for nursing college students, latest graduates, and nurses in specialized exercise regions like domestic health, college nursing, and correctional nursing.

This insurer is ideal for nursing college students who want scientific rotation insurance, nurses operating in non-conventional settings, and people looking for specialized endorsements for precise exercise situations.

Premium and Coverage Details

Student nurse insurance is remarkably cheap at just $39 consistent with 12 months for $1M/$6M limits at some stage in scientific rotations. This better combination restrict acknowledges that scholars paintings in more than one centers at some stage in their schooling. RN insurance begins off evolved at $109 yearly for $1M/$3M limits as soon as you`re licensed.

HPSO covers nursing college students at some stage in all scientific studies consisting of preceptorship and capstone projects. Their regulations consist of insurance for abilities check-offs and simulation lab activities. License protection insurance starts off evolved protective you even earlier than you by skip NCLEX, masking your scholar permit.

They provide area of expertise endorsements for college nurses, camp nurses, forensic nurses, and parish nurses at no extra cost. HPSO consists of attack insurance and prison illustration for Board of Nursing investigations. Free persevering with schooling publications are supplied to all policyholders, with subjects particularly selected to lessen legal responsibility risk.

HPSO’s 24/7 hotline is staffed through nurse legal professionals who can offer instant steering at some stage in essential situations. You can observe on-line at hpso.com, and scholar nurses can normally get accredited inside hours.

6. Marsh Healthcare Practice — Best for Nurse Practitioners and CRNAs

Marsh Healthcare Practice focuses solely on superior exercise providers, imparting state-of-the-art insurance designed for the complicated legal responsibility panorama going through unbiased practitioners. Their guidelines are tailor-made for nurse practitioners, licensed registered nurse anesthetists, and nurse midwives who face better legal responsibility publicity than team of workers nurses.

This organization is right for NPs with unbiased exercise or possession of clinics, CRNAs running in surgical procedure facilities or non-public exercise, and nurse midwives attending births in diverse settings.

Premium and Coverage Details

Annual rates variety from $one hundred twenty five to $350 relying on specialty, with CRNAs generally on the better cease because of multiplied chance. Coverage limits increase up to $1M/$6M aggregate, and custom limits may be organized for practitioners who want more advantageous protection. Both prevalence and claims-made guidelines are available.

Marsh consists of complete cyber legal responsibility and information breach insurance, vital for practitioners retaining unbiased EHR systems. Their guidelines cowl telehealth and telemedicine consultations throughout country lines. Business overhead insurance may be brought to shield your earnings if you`re not able to exercise because of a protected claim. They offer insurance for locum tenens paintings and moonlighting positions.

License protection insurance extends to DEA, country, and countrywide certification protection. Marsh assigns devoted chance control specialists to every policyholder, offering proactive loss prevention advice. Their claims protection crew consists of lawyers who focus on superior exercise nursing, information the nuances of NP and CRNA scope of exercise.

You can attain fees via healthcare coverage agents or immediately via Marsh’s healthcare exercise division. They additionally provide institution prices for multi-company practices and clinics.

7. American Professional Agency — Best for Travel Nurses and Multi-State Coverage

American Professional Agency makes a speciality of transportable insurance for nurses who paintings throughout country lines, along with journey nurses, company nurse, and army nurses. Their guidelines robotically make bigger insurance to all states in which you`re certified without extra charges or endorsements.

This service is ideal for journey nurses transferring among assignments, company nurses running for more than one healthcare staffing company, and army nurses with multi-country compact licenses.

Premium and Coverage Details

Annual charges variety from $89 to $225 for $1M/$3M insurance, with costs primarily based totally to your number one area of expertise as opposed to location. This manner you pay one constant charge irrespective of which country you are running in in the course of the coverage period. Monthly charge alternatives begin at $7.50, making insurance cheap even for nurses among assignments.

Their guidelines robotically cowl you in all 50 states without requiring notification while you pass to a brand new challenge. License protection insurance extends to all states in which you preserve licensure. They consist of insurance for orientation durations and gaps among assignments, so you are covered even if now no longer actively running.

American Professional Agency covers each facility-primarily based totally and company employment simultaneously, doing away with the want for more than one guidelines. They recognize the particular demanding situations journey nurses face and offer 24/7 claims aid with representatives skilled in multi-country exercise issues.

Their guidelines consist of attack insurance and safety for true Samaritan acts. Contract assessment offerings assist you recognize the legal responsibility implications of journey assignments earlier than you sign. You can follow on-line at americanprofessional.com, and that they provide expedited processing for nurses wanting insurance to begin a brand new challenge quickly.

How to Choose the Right Nurse Malpractice Insurance — Step-by-Step Selection Guide

Step 1: Determine Your Coverage Needs

Start via way of means of assessing your exercise putting and chance level. Staff nurses operating in hospitals below near supervision usually want standard $1M/$3M insurance. Advanced exercise nurses with prescriptive authority or unbiased exercise ought to bear in mind better limits of $2M/$6M.

Travel nurses want multi-kingdom insurance that mechanically extends throughout kingdom lines. Consider whether or not you want occurrence-primarily based totally insurance for long-time period safety or if claims-made insurance with decrease rates meets your needs.

Step 2: Compare Premium Costs vs. Coverage Benefits

Don`t select coverage primarily based totally on price. Coverage that costs $50 much less in line with year however excludes license protection insurance ought to fee you $50,000 in case you face a Board of Nursing complaint. Calculate the authentic fee via way of means of dividing the once a year top rate via way of means of 365 to peer your everyday fee. Most nurses pay among 25 cents and eighty cents in line with day for complete safety. Compare what is protected with inside the base top rate: license protection, attack insurance, criminal protection costs, and chance control resources.

Step 3: Verify License Defense Coverage

Confirm that your coverage specially consists of prison illustration for State Board of Nursing investigations and complaints. This insurance has to be similarly for your coverage limits, now no longer deducted from them. Ask whether or not the coverage employer assigns you and lawyer or if you could pick out your personal prison illustration. Check if insurance extends to license renewal issues, persevering with training audits, and scope of exercise questions that would stand up in the course of Board investigations.

Step 4: Check Coverage Portability and Multi-State Options

If you may move, alternate employers, or paintings throughout kingdom lines, confirm that your insurance follows you. Ask whether or not you want to inform the coverage employer whilst converting jobs or locations. Confirm that the coverage covers volunteer paintings, in step with Diem shifts, and proper Samaritan acts out of doors your number one employment. Travel nurses have to make certain automated insurance in all states wherein they keep licensure.

Step 5: Review the Claims Reporting Process

Understand the way to document a ability declare or incident. Look for providers with 24/7 claims hotlines staffed via way of means of specialists who apprehend nursing exercise. Check whether or not you could document incidents on-line or via a cell app. Ask approximately the common reaction time while you document a declare and whether or not you`ll have a committed claims adjuster or lawyer assigned for your case.

Step 6: Read the Policy Exclusions Carefully

Every coverage has exclusions. Common exclusions consist of intentional harm, crook acts, sexual misconduct, and substance abuse even as on duty. Some regulations exclude particular processes or treatments, so affirm your distinctiveness is protected. Check exclusions associated with running outdoor your scope of exercise or in unlicensed settings. Understanding what`s now no longer protected is simply as essential as understanding what is.

Step 7: Consider Additional Benefits and Discounts

Many vendors provide precious extra advantages past fundamental coverage. Look totally free persevering with training courses, hazard control resources, felony recommendation hotlines, and identification robbery protection. Check for to be had reductions which includes multi-12 months coverage reductions, claims-unfastened reductions, expert affiliation member reductions, and new patron promotions. These extras can substantially beautify the price of your coverage.

Expert Tip from Nurse Educator’s Insight

Don`t Wait until You Need It: The largest mistake nurses make is ready to buy malpractice coverage till after an incident takes place or they acquire a grievance notice. At that point, it is too late. Claims-made regulations simplest cowl incidents that arise after your insurance begins, so shopping for coverage after a capability declare state of affairs affords 0 safety for that incident.

Purchase insurance at some point of your first nursing process and preserve non-stop insurance at some point of your profession. Even a one-day hole in insurance can depart you uncovered to uninsured claims from that period. Think of malpractice coverage like your nursing license: it is now no longer non-obligatory; it is crucial expert safety you preserve constantly at some point of your profession.

Conclusion: Protect Your License and Your Future

Nurse malpractice coverage is not non-obligatory in trendy litigious healthcare environment. For much less than the price of 1 dinner out in line with month, you could defend your nursing license, non-public assets, and expert recognition from devastating lawsuits. The seven groups reviewed right here all provide complete insurance with verified claims support, however your best desire relies upon for your exercise setting, budget, and precise needs.

NSO and HPSO lead for ordinary fee and complete insurance. Berxi gives unbeatable quotes for brand spanking new graduates. Proliability and Marsh offer specialized safety for superior exercise nurses. CM&F grants budget-pleasant alternatives without sacrificing essentials. American Professional Agency serves tour nurses with seamless multi-kingdom insurance.

Don’t depart your profession to chance. Choose coverage nowadays and exercise with self-belief understanding you are blanketed. Most companies provide immediately on-line costs and on the spontaneously insurance, so that you may be blanketed inside minutes.

Next Steps: Visit our complete manual on Free CEU Courses for Nurses — Instant Certificate Downloads for License Renewal to find out a way to meet your persevering with schooling necessities without spending masses on courses.

Frequently Asked Questions About Nurse Malpractice Insurance

Do I really need malpractice insurance if my hospital has coverage?

Yes, you clearly want your personal coverage. Hospital coverage protects the facility, now no longer character nurses. If a lawsuit names each you and the medical institution, their legal professional can also additionally argue you acted out of doors medical institution coverage to shift legal responsibility far from the facility. Your private coverage offers you your personal legal professional who represents handiest your interests.

Additionally, medical institution insurance doesn`t shield you out of doors paintings all through volunteer activities, in line with diem shifts at different facilities, or accurate Samaritan situations. It additionally might not cowl State Board of Nursing investigations or license protection proceedings.

What’s the distinction among incidence and claims-made insurance for nurses?

Occurrence insurance protects you for any incident that takes place even as your coverage is active, even though the declare is filed years once you cancel insurance. Claims-made insurance handiest protects you if each the incident and the declare manifest even as your coverage is active. If you allow claims-made insurance lapse, you want “tail insurance” to shield towards late-filed claims. Occurrence expenses greater however presents lifetime safety on your coverage period. Claims-made is greater cheap and works nicely in case you preserve non-stop insurance for the duration of your career.

How plenty does nurse malpractice coverage fee in line with month?

Most RNs pay among $10 and $25 in line with month for comprehensive $1M/$3M insurance while paying monthly. LPNs normally pay $eight to $18 monthly. Annual fee is cheaper, ranging from $a hundred to $three hundred in line with 12 months for RNs and $eighty five to $two hundred for LPNs. Advanced exercise nurses pay greater, normally $a hundred twenty five to $350 yearly relying on specialty. The fee breaks right all the way down to much less than one greenback in line with day for maximum nurses, making it one of the maximum cheap varieties of expert safety available.

Does malpractice coverage cowl criminal costs for nursing board court cases?

Quality malpractice guidelines encompass license protection insurance that can pay for legal professional illustration all through State Board of Nursing investigations, hearings, and proceedings. This insurance is normally similarly on your coverage limits, now no longer deducted from them. License protection covers court cases associated with scope of exercise, documentation issues, affected person care concerns, and different expert behavior matters. Without this insurance, nurses can pay $10,000 to $50,000 in criminal costs protecting their license, even though the grievance is in the end dismissed.

Can tour nurses get malpractice coverage that covers all states?

Yes, numerous companies concentrate on multi-kingdom insurance for tour nurses. Companies like American Professional Agency, NSO, and Berxi provide guidelines that mechanically cowl you in all states in which you are certified without requiring extra charges or endorsements. You do not want to inform them while transferring among assignments. Make certain your coverage mainly states it covers tour nursing and employer paintings throughout a couple of states. Also affirm that insurance extends all through gaps among assignments and orientation intervals at new facilities.

Web Story:

Read More:

https://nurseseducator.com/didactic-and-dialectic-teaching-rationale-for-team-based-learning/

https://nurseseducator.com/high-fidelity-simulation-use-in-nursing-education/

First NCLEX Exam Center In Pakistan From Lahore (Mall of Lahore) to the Global Nursing

Categories of Journals: W, X, Y and Z Category Journal In Nursing Education

AI in Healthcare Content Creation: A Double-Edged Sword and Scary

Social Links:

https://www.facebook.com/nurseseducator/

https://www.instagram.com/nurseseducator/

https://www.pinterest.com/NursesEducator/

https://www.linkedin.com/company/nurseseducator/

https://www.linkedin.com/in/nurseseducator/

https://www.researchgate.net/profile/Afza-Lal-Din

https://scholar.google.com/citations?hl=en&user=F0XY9vQAAAAJ

Definitely believe that that you said. Your favourite justification seemed to be at the web the easiest thing

to bear in mind of. I say to you, I definitely get annoyed

whilst folks consider worries that they plainly do not understand about.

You managed to hit the nail upon the highest and outlined out the whole thing without having side effect , folks could take a signal.

Will probably be back to get more. Thank you

Great article! It really highlights how crucial having personal malpractice insurance is for nurses, regardless of their employer’s coverage. This is such an important topic for financial and career protection.

Reading this made me think of a related question, especially for those of us who might be considering travel nursing assignments or even relocating to the U.S. I apologize for including a link, but I think it helps provide better context for my question.

How does the need for and the process of obtaining personal malpractice insurance differ for an internationally educated nurse, say from the EU, who is planning to work in the United States on a visa? Would they need to secure a U.S.-based malpractice policy like the ones listed here before they even start applying for jobs, or is this typically handled by the employing hospital as part of the relocation package? I was reading this guide https://pillintrip.com/es/article/medical-insurance-for-usa-travelers-and-relocants-your-complete-protection-guide which talks about health insurance for travelers and relocants, but it got me wondering about the professional liability side of things for healthcare workers specifically.

Thanks for any insight!

What is mirror life? Scientists are sounding the alarm

https://advocatdnepr.com.ua/ru/military-lawyer-from-zaporozhye/

Военный адвокат Запорожье

[img]https://advokats-zp.com.ua/wp-content/uploads/elementor/thumbs/-%D0%90%D0%B4%D0%B2%D0%BE%D0%BA%D0%B0%D1%82-%D0%97%D0%B0%D0%BF%D0%BE%D1%80%D0%BE%D0%B6%D1%8C%D0%B53-q192no85jfgs5nb51mwbf2t4du4lf4nohwdjrhm2xs.webp[/img]

[url=https://www.advokat-zp.best/ru/%D0%B2%D1%96%D0%B9%D1%81%D1%8C%D0%BA%D0%BE%D0%B2%D0%B8%D0%B9-%D0%B0%D0%B4%D0%B2%D0%BE%D0%BA%D0%B0%D1%82-%D1%83-%D0%B7%D0%B0%D0%BF%D0%BE%D1%80%D1%96%D0%B6%D0%B6%D1%96/]Военный адвокат Запорожье[/url]

Scientist Kate Adamala doesn’t remember exactly when she realized her lab at the University of Minnesota was working on something potentially dangerous — so dangerous in fact that some researchers think it could pose an existential risk to all life forms on Earth.

She was one of four researchers awarded a $4 million US National Science Foundation grant in 2019 to investigate whether it’s possible to produce a mirror cell, in which the structure of all of its component biomolecules is the reverse of what’s found in normal cells.

The work was important, they thought, because such reversed cells, which have never existed in nature, could shed light on the origins of life and make it easier to create molecules with therapeutic value, potentially tackling significant medical challenges such as infectious disease and superbugs. But doubt crept in.

“It was never one light bulb moment. It was kind of a slow boiling over a few months,” Adamala, a synthetic biologist, said. People started asking questions, she added, “and we thought we can answer them, and then we realized we cannot.”

The questions hinged on what would happen if scientists succeeded in making a “mirror organism” such as a bacterium from molecules that are the mirror images of their natural forms. Could it inadvertently spread unchecked in the body or an environment, posing grave risks to human health and dire consequences for the planet? Or would it merely fizzle out and harmlessly disappear without a trace?

I like the helpful information you provide in your articles. I will bookmark your blog and check again here regularly. I’m quite certain I’ll learn lots of new stuff right here! Good luck for the next!

I read this article fully concerning the resemblance of newest and earlier technologies,

it’s awesome article.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**pineal xt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potentstream**

potentstream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepatoburn**

hepatoburn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.