Explore Top Nurse Malpractice Insurance Providers: NSO vs. CM&F: A Brutally Honest 2026 Comparison. NSO vs. CM&F nurse malpractice coverage assessment 2026. Discover which pinnacle company gives higher insurance, rates, and claims aid for nursing professionals.

NSO vs. CM&F: A Brutally Honest 2026 Comparison of Top Nurse Malpractice Insurance Providers

Introduction

Professional legal responsibility coverage stays one of the maximum vital but misunderstood elements of nursing exercise. According to the National Practitioner Data Bank`s 2024 annual report, over 4,800 malpractice claims had been filed in opposition to registered nurses closing year, with common agreement fees exceeding $287,000. Despite those sobering statistics, about 40% of practicing nurses continue to be uninsured, depending totally on agency-supplied insurance that might not shield their non-public belongings or license.

When discovering man or woman malpractice coverage, names always dominate the conversation: Nurses Service Organization and Consolidated Medical Financial. This complete assessment examines each company throughout vital dimensions together with insurance options, pricing structures, claims handling, and patron service, supplying the evidence-primarily based totally evaluation nurses want to make knowledgeable safety decisions.

Understanding Nurse Malpractice Insurance Fundamentals

Why Individual Coverage Matters Beyond Employer Policies

Many nurses mistakenly accept as true with their agencies malpractice coverage gives enough safety. However, institutional regulations are designed to shield the employer first, now no longer man or woman practitioners. According to analysis posted inside the Journal of Nursing Law, agency regulations include several exclusions that go away nurses for my part vulnerable, together with insurance gaps for moves out of doors task descriptions, volunteer work, moonlighting positions, or conditions wherein agency and worker hobbies conflict.

The prison precept of respondent advanced indicates employers endure obligation for worker moves in the scope of employment. However, this safety evaporates in instances regarding alleged intentional misconduct, crook activity, or board of nursing disciplinary court cases. Patricia Benner’s studies on nursing understanding emphasizes that as nurses enhance in exercise autonomy, their man or woman legal responsibility publicity will increase proportionally, making non-public insurance an increasing number of essential.

Furthermore, agency regulations generally do not cowl protection fees for nation board investigations, that have elevated through 34% considering that 2020 is keeping with the National Council of State Boards of Nursing. These administrative court cases can bring about license suspension or revocation irrespective of civil lawsuit outcomes. Individual regulations particularly deal with this vital gap, supplying committed prison illustration for licensure protection break away malpractice declare insurance.

Nurses Service Organization: Comprehensive Provider Analysis

Company Background and Market Position

Nurses Service Organization, set up in 1976 and underwritten through The Healthcare Providers Service Organization, dominates the nurse malpractice coverage marketplace with about 900,000 insured healthcare professionals. NSO’s unique consciousness on nursing and allied fitness professions has cultivated deep understanding in profession-unique dangers and regulatory environments. The organization continues to achieve an A.M. Best score of As, indicating terrific monetary energy and claims-paying ability.

NSO’s toughness gives treasured insights into long-time period declaring developments and rising legal responsibility dangers inside nursing exercise. Their chance control resources, advanced over almost 5 decades, mirror accrued understanding from reading hundreds of real nursing claims. This institutional reminiscence interprets into greater state-of-the-art insurance layout and proactive chance prevention equipment that advantage policyholders.

The organization`s partnership with the American Nurses Association lends extra credibility and guarantees coverage improvement aligns with expert requirements and evolving exercise expectations. NSO actively participates in nursing coverage discussions, contributing to more secure exercise environments whilst concurrently informing insurance selections primarily based totally on rising healthcare trends.

Coverage Options and Policy Features

NSO gives occurrence-primarily based totally and claims-made guidelines with insurance limits ranging from $1 million in step with incident and $three million mixture to $6 million in step with incident and $10 million mixture for superior exercise registered nurses. Their preferred guidelines consist of automated insurance for prison illustration in nation board investigations up to $25,000, attack insurance offering $10,000 for crook protection if assaulted whilst offering affected person care, and private legal responsibility insurance extending to non-expert conditions.

The guidelines consist of clinical incident insurance protective nurses at some stage in emergency reaction conditions out of doors their employment, important for nurses who prevent at twist of fate scenes or offer volunteer clinical assistance. Deposition illustration guarantees prison recommend accompanies nurses at some stage in depositions even if no formal declaration has been filed, addressing the traumatic truth that many investigations by no means materialize into complaints however nevertheless require expert prison guidance.

NSO’s supplemental coverages consist of license safety protection reimbursement, discrimination and sexual harassment protection insurance, and private harm safety. These additions understand that cutting-edge nursing exercise exposes practitioners to various legal responsibility eventualities past conventional malpractice allegations. The complete technique displays expertise that nurses want holistic safety in more complicated healthcare environments.

Pricing Structure and Discount Opportunities

NSO’s base top rate for RN insurance with $1 million/$three million limits averages $ninety eight yearly, although prices range considerably primarily based totally on forte, exercise setting, and geographic location. Critical care nurses, emergency branch practitioners, and exertions and shipping experts face better charges reflecting accelerated litigation frequency in those specialties. Conversely, nurses in faculty health, occupational health, or cellphone triage roles experience considerably decreased prices.

Multiple bargain possibilities lessen expenses considerably. Full-time pupil nurses acquire 50% discounts, newly certified nurse’s inside their first year qualify for decreased prices, and ANA individuals shop a further 10%. Bundling a couple of guidelines, preserving non-stop insurance without lapses, and finishing danger control persevering with schooling guides cause extra top rate reductions.

Advanced exercise registered nurses consisting of nurse practitioners, licensed nurse anesthetists, and scientific nurse experts face better charges ranging from $three hundred to $2,000+ yearly relying on forte and prescriptive authority status. However, NSO’s APRN prices continue to be aggressive with standard clinical malpractice coverage whilst offering nursing-unique blessings unavailable via physician-orientated carriers.

Consolidated Medical Financial: In-Depth Provider Evaluation

Company Overview and Industry Standing

Consolidated Medical Financial, based in 1984 and underwritten via way of means of Continental Casualty Company (a part of CNA Financial Corporation), represents an impressive opportunity with inside the nurse malpractice coverage marketplace. While smaller than NSO in nursing-unique marketplace share, CM&F advantages from CNA`s good sized economic assets and A score from A.M. Best, making sure long-time period balance and claims-paying capacity.

CM&F differentiates itself via bendy underwriting and willingness to insure better-hazard specialties that different vendors occasionally decline or rate prohibitively. Their technique appeals to nurses with preceding claims history, the ones running in high-litigation-hazard settings, or practitioners engaged in more than one simultaneous nursing role requiring complicated insurance structuring.

The company’s integration in the large CNA agency affords get entry to state-of-the-art felony networks and claims control assets normally reserved for large business accounts. This infrastructure gain interprets into probably quicker claims decision and gets entry to specialized felony know-how throughout numerous exercise areas.

Coverage Provisions and Policy Distinctions

CM&F affords prevalence and claims-made guidelines with fashionable limits of $1 million in step with prevalence and $three million aggregate, expandable to better limits for superior practitioners. Their guidelines consist of computerized board protection insurance up to $50,000, drastically better than much competition such as NSO’s fashionable $25,000 limit. This improved safety proves specially treasured in states with competitive nursing board research practices.

Unique to CM&F is their integrated telehealth insurance without extra endorsements or top-class surcharges, addressing the fast growth of digital care shipping elevated via way of means of pandemic-technology exercise changes. As telehealth will become everlasting infrastructure as opposed to brief lodging, this forward-questioning insurance detail affords extensive value.

CM&F guidelines consist of blanket extra insured endorsements permitting nurses to feature employers, facilities, or companies as extra insureds without man or woman coverage amendments. This flexibility streamlines insurance for nurses preserving more than one in step with diem positions or often converting employment settings, getting rid of administrative burden and capability insurance gaps during transitions.

Cost Comparison and Payment Flexibility

CM&F’s pricing for RN insurance with $1 million/$three million limits begins off evolved around $one hundred and five annually, barely better than NSO’s base prices however frequently similar after discounts. However, CM&F’s willingness to insure better-hazard eventualities occasionally decreases in competition that both decline insurance or observe well sized surcharges for sure exercise configurations.

Payment flexibility distinguishes CM&F from much competition. They provide month-to-month fee plans without financing charges, quarterly billing options, and institutional billing for organization guidelines overlaying more than one nurses inside unmarried companies. This administrative lodging advantages journey nurses, in step with diem practitioners, or latest graduates dealing with tight budgets.

CM&F affords multi-yr price locks ensuring top class balance for nurses buying or three-yr guidelines, defensive in opposition to sudden price increase and simplifying long-time period economic planning. This choice specially appeals to nurses in strong exercise conditions, searching for predictable coverage prices without annual renewal rate uncertainty.

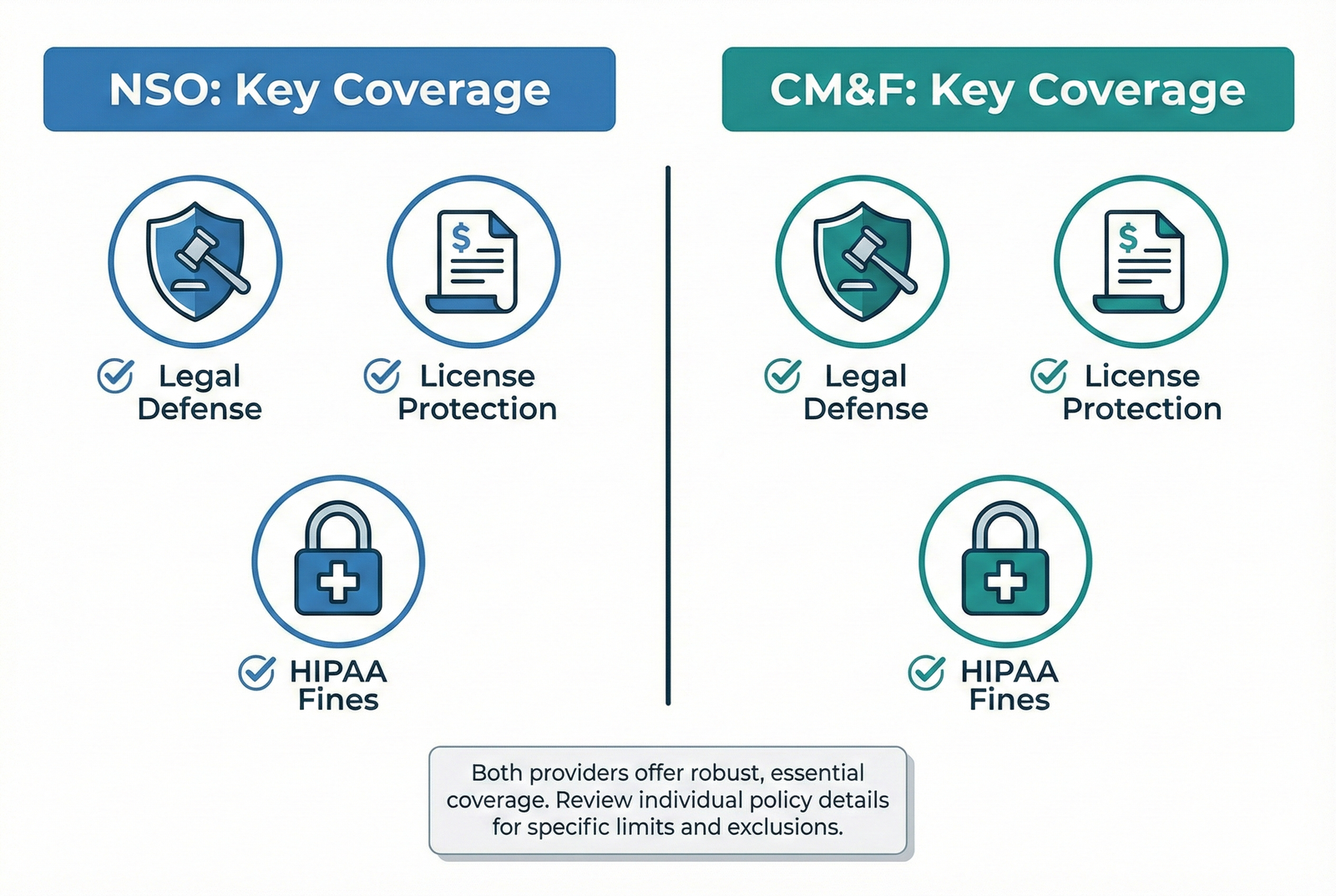

Direct Feature Comparison: NSO vs. CM&F

Claims Handling and Legal Support

NSO`s claims branch employs nurse felony specialists who recognize scientific exercise realities and might talk successfully with defendant nurses. This nursing-particular understanding doubtlessly reduces pressure in the course of claims approaches as adjusters recognize scientific documentation, popular of care problems, and exercise surroundings constraints. Their claims pleasure scores continuously exceed enterprise averages primarily based totally on impartial coverage pleasure surveys.

CM&F leverages CNA’s great felony panel consisting of legal professionals that specialize in healthcare protection throughout all 50 states. While adjusters might also additionally lack nursing-particular backgrounds, get admission to top-tier felony illustration and tremendous agreement authority regularly hurries up declare resolution. Some nurse’s document quicker claims closure and greater competitive protection postures from CM&F as compared to smaller uniqueness carriers.

Both agencies offer 24/7 claims reporting and instant get admission to felony session following unfavorable events. Neither employer calls for deductibles for protected claims, and each offers complete protection price insurance without eroding coverage limits. These popular functions throughout each company make certain nurses acquire instant aid during disaster conditions irrespective of provider selection.

Risk Management and Educational Resources

NSO excels in nursing-particular hazard control training, supplying great persevering with training libraries, month-to-month newsletters reading current malpractice cases, and uniqueness-particular hazard discount strategies. Their sources align with nursing frameworks consisting of Jean Watson’s Theory of Human Caring and Dorothea Orem’s Self-Care Deficit Theory, integrating hazard control inside holistic nursing exercise instead of treating it as separate compliance burden.

CM&F presents strong hazard control sources although much less nursing-particular than NSO’s offerings. Their substances regularly cope with broader healthcare hazard problems relevant throughout a couple of professions. However, CNA’s great hazard manages consulting offerings grow to be to be had for institution regulations or large accounts, doubtlessly supplying greater state-of-the-art loss prevention packages for healthcare centers using a couple of insured nurses.

Both companies provide complimentary persevering with training credits, coverage reductions for finishing hazard control courses, and normal communications highlighting rising legal responsibility trends. NSO’s nursing exclusivity presents greater centered content, at the same time as CM&F’s broader healthcare recognition every now and then gives treasured cross-expert views on systemic protection problems.

Customer Service and Policy Administration

NSO continues committed nursing customer support representatives to be had prolonged hours consisting of weekend availability, spotting that nurses paintings non-conventional schedules. Their on line portal permits immediately certificates of coverage generation, insurance verification, and coverage control without cellphone contact. Customer pleasure surveys continuously rank NSO’s responsiveness and information many of the maximum in uniqueness coverage sectors.

CM&F gives expert customer support through CNA’s installed infrastructure, although representatives might also additionally deal with a couple of product traces instead of nursing-distinctive recognition. Response instances continue to be competitive, and the web portal presents comparable self-carrier skills. Some nurses document desire for NSO’s nursing-particular carrier approach, at the same time as others fee CM&F’s integration with broader industrial coverage skills for bundling private coverage needs.

State-Specific Considerations and Coverage Variations

Malpractice coverage necessities and lawsuit environments range dramatically throughout states, influencing company selection. States like Florida, New York, and Pennsylvania with better litigation frequencies and large harm awards may also justify better insurance limits irrespective of carrier. Both NSO and CM&F alter rates reflect nation-unique danger profiles, from time to time ensuing in full-size rate variations for same insurance in extraordinary jurisdictions.

Some states mandate unique insurance capabilities or minimal limits for superior exercise nurses with prescriptive authority. Both vendors make sure nation compliance, however nurses ought to affirm that decided on guidelines meet licensing board necessities. Certain states understand most effective incidence guidelines for unique exercise types, even as others receive both incidence and claims-made formats.

Nurses training throughout nation lines, not unusual place amongst tour nurses or the ones conserving compact licenses, require guidelines overlaying multi-nation exercise. Both NSO and CM&F accommodate multi-nation insurance, although top class calculations and unique phrases may also range. Clarifying exercise places for the duration of utility guarantees right insurance without sudden gaps.

Making the Decision: Which Provider Suits Your Needs?

Choosing among NSO and CM&F relies upon on person circumstances, exercise traits, and private preferences. NSO represents the more potent desire for nurses prioritizing nursing-unique understanding, massive danger control resources, and customer support from representative’s know-how nursing exercise nuances. Their marketplace dominance, ANA affiliation, and nursing-one-of-a-kind recognition offer reassurance that coverage layout particularly addresses nursing legal responsibility realities.

CM&F appeals to nurses searching for stronger board protection limits, integrated telehealth insurance, price flexibility, or people with complicated exercise conditions requiring custom designed underwriting. Their CNA backing affords monetary power confidence, and their willingness to insure better-danger situations serves nurses who would possibly face insurance demanding situations elsewhere.

Budget-aware nurses ought to attain fees from each provider, as pricing varies primarily based totally on specialty, location, and person danger factors. The small top-class variations hardly ever justify sacrificing desired insurance capabilities or customer support approaches. Both agencies provide top notch prices in comparison to going uninsured, making desire hugely advanced to depending completely on corporation insurance.

Conclusion

The NSO vs. CM&F choice in the long run displays non-public priorities in preference to goal superiority of both companies. Both agencies provide financially stable, professionally controlled malpractice coverage particularly designed for nursing exercise. NSO`s nursing exclusivity, massive instructional resources, and specialized customer support create compelling blessings for nurses valuing profession-unique understanding and support.

CM&F’s stronger board protection insurance, integrated telehealth protection, and bendy price alternatives serve nurses with unique wishes or exercise traits requiring custom designed approaches. Regardless of selection, acquiring person expert legal responsibility coverage represents critical danger control that protects each expert license and private monetary security.

The incredibly modest annual funding affords useful peace of thought in a more and more litigious healthcare surroundings wherein an unmarried declared may want to devastate an uninsured nurse’s monetary destiny and profession trajectory. Smart nurses understand that expert legal responsibility coverage is not non-compulsory however instead essential expert infrastructure as critical as retaining licensure itself.

FAQs

FAQ 1: Can I switch from NSO to CM&F or vice versa without coverage gaps?

Yes, cautiously timing the brand-new coverage powerful date to suit or precede the earlier coverage expiration guarantees non-stop insurance, although claims-made rules require tail insurance or earlier acts endorsements whilst switching.

FAQ 2: Do NSO and CM&F cowl nurse practitioners acting strategies like joint injections or beauty treatments?

Both cowls accept strategies inside scope of exercise and training; however, beauty or aesthetic strategies can also additionally require specialized endorsements or separate rules relying on carrier frequency and sales generation.

FAQ 3: Will both company cowl me if I`m sued for something that passed off earlier than I bought the coverage?

Occurrence rules cowl incidents at some point of the coverage length no matter declaring timing, whilst claims-made rules require earlier acts insurance or tail insurance for incidents previous coverage inception.

FAQ 4: How do NSO and CM&F cope with claims if I’m named in a lawsuit at the side of my agency?

Both offer impartial felony illustration defensive your man or woman pursuits even if they diverge from agency pursuits, making sure your license and private property acquire devoted protection no matter agency positions.

Read More:

https://nurseseducator.com/didactic-and-dialectic-teaching-rationale-for-team-based-learning/

https://nurseseducator.com/high-fidelity-simulation-use-in-nursing-education/

First NCLEX Exam Center In Pakistan From Lahore (Mall of Lahore) to the Global Nursing

Categories of Journals: W, X, Y and Z Category Journal In Nursing Education

AI in Healthcare Content Creation: A Double-Edged Sword and Scary

Social Links:

https://www.facebook.com/nurseseducator/

https://www.instagram.com/nurseseducator/

https://www.pinterest.com/NursesEducator/

https://www.linkedin.com/company/nurseseducator/

https://www.linkedin.com/in/afzalaldin/

https://www.researchgate.net/profile/Afza-Lal-Din

https://scholar.google.com/citations?hl=en&user=F0XY9vQAAAAJ