Let Explore Do Nurses Really Need Malpractice Insurance? Legal Safety Explained 2025. Yes, nursing staff need professional liability insurance for their legal protection, as it provides essential financial protection and legal defense, in addition to the benefits of their employer’s policy.

Do Nurses Really Need Malpractice Insurance? Legal Safety Explained 2025

While hospital insurance covers many tasks, an individual policy is essential for self-employed professionals and nurses with broad skills. An individual policy is also essential to cover potential gaps in coverage, lawsuits, or claims that may arise due to personal liability or a discrepancy with their employer’s policy.

Introduction

Your sanatorium administrator confident you throughout orientation that the facility`s malpractice coverage covers you completely, so shopping your very own coverage might be wasteful. Then you pay attention the horror story: a former colleague named in a lawsuit found the sanatorium’s legal professionals defended the institution’s interests, now no longer hers individually, leaving her to rent personal suggest at $350 consistent with our whilst going through a $2 million claim.

This situation performs out extra regularly than nursing faculties admit, and it increases a query that might outline your economic future: do nurses actually need their very own malpractice coverage, or is organization insurance actually sufficient? The solution is not what maximum new nurses expect, and false impression this trouble has value nurses their savings, their homes, and their careers. Whether you are a new graduate beginning your first RN role or a skilled nurse who is by no means carried private insurance, knowledge the prison realities of nursing malpractice might be the maximum crucial economic selection you’re making to your career.

Quick Snapshot: Nurse Malpractice Insurance Essentials

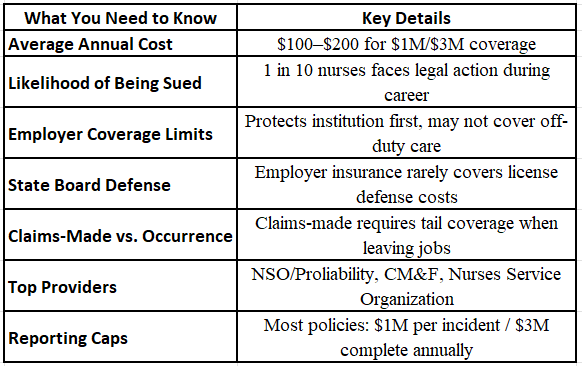

| What You Need to Know | Key Details |

| Average Annual Cost | $100–$200 for $1M/$3M coverage |

| Likelihood of Being Sued | 1 in 10 nurses faces legal action during career |

| Employer Coverage Limits | Protects institution first, may not cover off-duty care |

| State Board Defense | Employer insurance rarely covers license defense costs |

| Claims-Made vs. Occurrence | Claims-made requires tail coverage when leaving jobs |

| Top Providers | NSO/Proliability, CM&F, Nurses Service Organization |

| Reporting Caps | Most policies: $1M per incident / $3M complete annually |

What Is Malpractice Insurance for Nurses?

Malpractice insurance, as well called professional criminal duty insurance, is a limited insurance that protects nurses from financial criminal duty while patients or their family’s record lawsuits maintain negligence, errors, or substandard care. The insurance covers crook safety costs, court docket fees, settlement payments, and judgments as lots because the insurance limits if you`re determined liable.

The coverage works thru one in every of structures. Occurrence-primarily based totally regulations cowl any incident that occurred at the same time as the coverage changed into lively, irrespective of whilst the lawsuit is filed. If something takes place all through your insurance duration and a person sues you 5 years later, the coverage nonetheless responds. Claims-made regulations best cowl incidents that each took place and had been pronounced all through the lively coverage duration, this means that you want tail insurance (prolonged reporting endorsement) whilst you depart a activity or extrude insurers to defend in opposition to destiny claims from beyond work.

Professional legal responsibility coverage is awesome from trendy legal responsibility coverage. General legal responsibility covers such things as slip-and-fall injuries to your workplace or assets damage. Professional legal responsibility especially addresses allegations of expert negligence, errors in medical judgment, failure to comply with requirements of care, medicine errors, documentation failures, failure to endorse for sufferers, and breach of affected person confidentiality.

Most nurses expect their corporation’s malpractice coverage offers entire protection, however corporation regulations are designed by and large to defend the institution’s property and reputation, now no longer person nurses’ private interests. This creates a risky hole that private malpractice coverage fills.

Why Nurses Need Personal Malpractice Insurance

Employer Coverage Protects the Hospital, Not You

Hospital malpractice regulations listing the organization because the number one insured party. When complaints call each the medical institution and character nurses, the medical institution`s legal professionals attention on protecting the organization and minimizing its economic legal responsibility. If protective the medical institution calls for demonstrating which you acted outdoor coverage or towards orders, the legal professionals will make that argument although it damages your defense.

This creates a struggle of hobby wherein the medical institution’s prison group may throw you beneath the bus to defend the organization. They may argue you violated protocols, didn’t observe doctor orders properly, or acted past your scope of practice all to shift legal responsibility far from the medical institution and onto you for my part. Without your personal legal professional funded via way of means of private malpractice coverage, you haven’t any one advocating specially to your interests.

Employer Insurance Has Coverage Gaps

Employer malpractice regulations commonly exclude insurance for sports outdoor your employment duties. If you offer emergency care at a vehicle twist of fate scene, volunteer at a network fitness fair, advocate a neighbor approximately their medications, or paintings a according to diem shift at a distinct facility, your business enterprise’s coverage does not cowl the ones sports. Any lawsuit springing up from those conditions leaves you for my part responsible for all charges and judgments.

Additionally, business enterprise insurance ends the instant your employment terminates whether or not via resignation, termination, or retirement. If a person documents a lawsuit months or years after you have left that business enterprise concerning care you supplied whilst hired there, you haven’t any insurance until you bought tail insurance or maintained private coverage. Most nurses do not realize this hole exists till they obtain prison files disturbing response.

State Board Investigations Aren’t Covered

When sufferers document court cases together along with your nation board of nursing, the ensuing research and ability disciplinary hearings are administrative proceedings, now no longer court cases. Employer malpractice coverage particularly excludes insurance for nation board protection due to the fact those aren`t civil legal responsibility matters. The charges of hiring legal professionals to symbolize you earlier than the board, making ready your protection, attending hearings, and attractive destructive choices come completely out of your pocket.

State board protection can fee $10,000 to $50,000 relying at the complexity of the case, and a destructive locating can bring about license suspension, obligatory remediation, probation, or everlasting license revocation. Personal malpractice regulations usually consist of nation board protection insurance with separate limits, protective each your license and your budget for the duration of those proceedings.

Personal Assets Are at Risk without Coverage

If a courtroom docket unearths you individually accountable for damages exceeding to be had coverage insurance or when you have no insurance at all, plaintiffs can pursue your private property to meet judgments. This consists of your property equity, financial institution accounts, retirement savings, automobile equity, and destiny wages thru garnishment. A unmarried catastrophic case may want to bankrupt you and ruin the economic safety you’ve got spent years building.

Nursing malpractice court cases mechanically contain claims of $500,000 to numerous million dollars, in particular in instances concerning everlasting injury, mind damage, or death. While maximum instances accept much less than preliminary demands, even a $100,000 judgment without coverage insurance could devastate maximum nurses financially. The particularly small annual fee of malpractice coverage presents widespread safety in opposition to this tail risk.

Criminal Defense Coverage Matters

Some nursing errors, especially the ones concerning managed substances, affected person abuse allegations, or gross negligence ensuing in death, can cause crook investigations along civil lawsuits. While malpractice coverage doesn`t cowl intentional crook acts, many rules encompass insurance for prison protection prices in the course of crook investigations and complaints in which the alleged behavior pertains to expert practice.

Without this insurance, hiring crook protection legal professionals at $three hundred to $500 in line with hour should cost $50,000 to $100,000 earlier than trial even begins. The monetary pressure of shielding yourself criminally at the same time as probably going through civil legal responsibility concurrently may be crushing. Personal malpractice coverage with crook protection insurance affords vital monetary safety in the course of those worst-case scenarios.

Malpractice Insurance Cost vs. Coverage Comparison

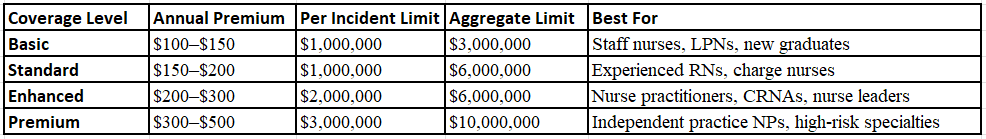

| Coverage Level | Annual Premium | Per Incident Limit | Aggregate Limit | Best For |

| Basic | $100–$150 | $1,000,000 | $3,000,000 | Staff nurses, LPNs, new graduates |

| Standard | $150–$200 | $1,000,000 | $6,000,000 | Experienced RNs, charge nurses |

| Enhanced | $200–$300 | $2,000,000 | $6,000,000 | Nurse practitioners, CRNAs, nurse leaders |

| Premium | $300–$500 | $3,000,000 | $10,000,000 | Independent practice NPs, high-risk specialties |

Most workforce nurses wearing standard $1 million in line with incident and $three million combination insurance pay approximately $a hundred to $a hundred and fifty annually. This represents much less than $thirteen in line with month or approximately 50 cents in line with shift for a full-time nurse. The insurance-to-price ratio makes malpractice coverage one of the maximum treasured investments nurses could make of their expert protection.

Premium fees range primarily based totally on numerous elements consisting of your nursing specialty, exercise setting, kingdom of exercise, claims history, insurance limits selected, and whether or not you pick incidence or claims-made insurance.

Step-by-Step Guide: Choosing and Acquire Malpractice Insurance

Step 1: Assess Your Personal Risk Profile

Start with the aid of using comparing your particular malpractice danger primarily based totally to your exercise surroundings and sports. Consider your nursing specialty, with better-danger regions like hard work and delivery, emergency, ICU, and surgical nursing dealing with extra common litigation than outpatient or administrative roles. Evaluate your paintings settings, as nurses operating a couple of jobs or consistent with Diem shifts want broader insurance than people with unmarried full-time employment.

Think approximately your off-responsibility nursing sports consisting of volunteer paintings, presenting casual clinical recommendation to buddies and family, participation in task journeys or catastrophe response, or any facet groups like fitness education or wellbeing consulting. Each of those sports creates capacity legal responsibility publicity that agency coverage won`t cowl. Also keep in mind your private monetary situation, due to the fact nurses with tremendous belongings like domestic equity, good sized savings, or funding portfolios have extra to guard with inside the occasion of detrimental judgments.

Step 2: Understand Claims-Made vs. Occurrence Coverage

Occurrence-primarily based totally regulations offer lifetime insurance for any incident that came about at some stage in the coverage length, irrespective of while a person documents a claim. If you had incidence insurance in 2025 and a person sues you in 2035 for something that came about in 2025, your 2025 coverage responds. This simplicity makes incidence regulations perfect for nurses who extrude jobs frequently, however they commonly value 10 to twenty percentage extra than claims-made regulations.

Claims-made regulations most effective cowl claims made at some stage in the lively coverage length for incidents that still came about at some stage in that length. When you cancel a claims-made coverage or transfer insurers, you want tail insurance (prolonged reporting endorsement) to guard towards destiny claims for beyond paintings. Tail insurance commonly charges a hundred and fifty to 2 hundred percentage of your very last annual premium, developing a tremendous cost while converting jobs or retiring. However, claims-made regulations value much less annually, and in case you preserve non-stop insurance with the identical insurer on your whole career, you keep away from tail insurance expenses.

For maximum nurses, incidence insurance affords higher price and peace of thoughts no matter the marginally better value. You’ll by no means fear approximately insurance gaps while converting jobs, and also you might not face a big tail insurance invoice at retirement.

Step 3: Stimulate Proper Coverage Limits

Standard insurance for maximum personnel nurses is $1 million consistent with incident with $three million mixture annually. This way the coverage can pay up to $1 million for any unmarried declare and a complete of $three million for all claims throughout the coverage year. This degree affords good enough safety for the sizable majority of nursing malpractice conditions and represents the minimal insurance maximum professionals recommend.

Nurses in high-chance specialties or people with sizeable private belongings must keep in mind better limits like $2 million consistent with incident and $6 million mixture. Advanced exercise nurses consisting of nurse practitioners, medical nurse specialists, and licensed registered nurse anesthetists frequently need $2 million to $three million consistent with incident limits because of their extended scope and extended legal responsibility exposure. The extra top class for better limits is exceedingly affordable, frequently only $50 to $one hundred greater annually.

Consider umbrella legal responsibility coverage when you have sizeable belongings exceeding your malpractice insurance limits. Personal umbrella regulations offer extra legal responsibility safety past your number one malpractice coverage and might cowl each expert and private legal responsibility conditions. These regulations commonly begin at $1 million extra insurance for approximately $2 hundred to $three hundred annually.

Step 4: Research Reputable Insurance Providers

Focus on mounted coverage organizations with sturdy monetary scores and unique revel in in nursing legal responsibility. NSO (Nurses Service Organization) and their underwriter CNA are the most important vendors of nurse malpractice coverage with inside the United States, protecting over 600,000 nurses with a long time of revel in managing nursing claims. CM&F Group focuses on healthcare expert legal responsibility with aggressive fees and super client service.

Pro-liability is some other important issuer presenting insurance especially designed for nurses with clean coverage language and complete chance control assets. HPSO (Healthcare Providers Service Organization) serves an extensive variety of healthcare experts consisting of nurses and gives each person and institution insurance options. Check every issuer`s AM Best rating, which assesses monetary electricity and cap-potential to pay claims, seeking out scores of A or higher.

Read coverage phrases cautiously due to the fact now no longer all malpractice coverage is identical. Compare what is covered in base insurance as opposed to what calls for extra endorsements. Key capabilities to search for encompass nation board protection insurance with separate limits, insurance for telehealth offerings if applicable, global insurance instead of simply US insurance, chance control assets and persevering with education, and 24/7 claims reporting hotlines.

Step five: Purchase Your Policy and Maintain Records

Once you have decided on a issuer and insurance level, the software method generally takes 10 to fifteen mins online. You’ll offer simple facts consisting of your name, license number, enterprise details, nursing specialty, and claims history. Most nurses without a previous claims get hold of on the spot approval and May down load their coverage files and coverage playing cards instantly.

Pay your top class yearly instead of month-to-month if financially possible. Annual fee frequently offers a five to ten percentage bargain as compared to month-to-month installments. Set a calendar reminder for 30 days earlier than your renewal date to study your insurance and make sure non-stop safety without lapses.

Store your coverage files, declarations web page displaying insurance limits and dates, coverage playing cards, and claims reporting facts in a couple of places consisting of bodily copies in a domestic file, virtual copies in cloud storage, and a replica of your coverage card to your pockets or badge holder. You want this facts right away reachable if a person serves you with criminal files or if you are concerned in an incident requiring reporting.

Step 6: Understand Your Reporting Obligations

Malpractice regulations are “claims-made and reported” which means you ought to file incidents, ability claims, and real complaints for your insurer directly to hold insurance. Most regulations require reporting inside a particular timeframe, frequently 60 days of turning into aware about an incident that might bring about a declare. Failure to file well timed can bring about denial of insurance even though the incident took place all through your insurance period.

Report any incident that might doubtlessly bring about a declare even though you`re unsure whether or not it will. Events requiring reporting encompass medicine mistakes inflicting affected person harm, affected person falls ensuing in injury, allegations of negligence from sufferers or families, court cases filed together along with your enterprise or country board, complaints or prison needs you receive, and any incident in which a affected person skilled surprising results probable associated with your care.

Your coverage agency presents a 24/7 hotline for incident reporting and instantaneously consultation. Use this aid each time you are unsure whether or not something calls for reporting. It’s usually higher to over-file than to danger insurance denial for failure to notify.

Expert Tip Box

Nurse Educator’s Insight:

Many nurses trust they don`t want malpractice coverage due to the fact they “constantly comply with policy” or “have by no means had problems.” This displays a risky false impression of the way legal responsibility works. You can offer best care and nonetheless face complaints due to the fact malpractice claims do not require evidence which you honestly did something wrong, simplest that a person alleges you did.

Defending you in opposition to even baseless claims expenses tens of hundreds of bucks in prison fees. Your malpractice coverage will pay for that protection no matter whether or not the declare has merit, that is regularly extra precious than the legal responsibility insurance itself. The query is not whether or not you are an excellent nurse, it is whether or not you could find the money for to protect yourself if a person questions your care years from now.

Real-World Scenarios Where Personal Coverage Matters

Scenario One: The Wrongful Death Allegation

Sarah, and skilled ICU nurse, cared for a septic affected person who deteriorated unexpectedly in spite of competitive treatment. The affected person died, and the own circle of relatives filed a wrongful demise lawsuit naming Sarah, the attending physician, and the hospital. The hospital`s legal professionals speedy settled with the own circle of relatives for $800,000, with the agreement settlement such as language that Sarah did not apprehend early sepsis symptoms and symptoms and behind schedule notifying the physician.

Because Sarah had non-public malpractice coverage, her insurer supplied an impartial lawyer who challenged this characterization and negotiated a separate agreement that covered no admission of wrongdoing with the aid of using Sarah. Without non-public insurance, Sarah could were certain with the aid of using the hospital’s agreement terms, doubtlessly growing a documented locating of negligence that could comply with her at some point of her profession and will have precipitated kingdom board investigation.

Scenario Two: The Good Samaritan Act Limits

Michael, an ER nurse, stopped at a coincidence scene and supplied emergency care to an injured motorcyclist. The affected person survived however filed a lawsuit claiming Michael’s positioning in the course of cervical backbone stabilization prompted extra injury. Michael assumed Good Samaritan legal guidelines supplied whole protection, however those legal guidelines range with the aid of using kingdom and commonly handiest shield towards gross negligence, now no longer normal negligence claims.

His employer’s coverage denied insurance due to the fact the incident took place off-obligation and outdoor his employment scope. Without non-public malpractice coverage, Michael confronted protecting the lawsuit completely at his personal expense. The case become ultimately dismissed, however Michael spent $22,000 on criminal protection earlier than dismissal. Personal malpractice coverage could have included those fees completely.

Scenario Three: The State Board Complaint

Jennifer, a med-surg nurse, made a medicinal drug blunders that didn`t damage the affected person however violated health facility protocol. The health facility stated the incident to the kingdom board as required. The board initiated a research and scheduled a disciplinary listening to. Jennifer’s organization coverage mainly excluded kingdom board lawsuits from insurance.

Jennifer employed a legal professional focusing on nursing license protection at $325 in step with hour. Between research response, listening to preparation, and the listening to itself, she accumulated $18,500 in felony fees. The board in the end imposed no field past requiring a medicinal drug protection persevering with training course. Had Jennifer carried private malpractice coverage with kingdom board protection insurance, the coverage might have protected all felony costs.

Scenario Four: The Post-Employment Lawsuit

David labored at a huge health facility gadget for 5 years earlier than leaving to pursue journey nursing. Eighteen months after leaving, he acquired be aware that a affected person’s own circle of relatives filed a lawsuit concerning care supplied 3 years in advance throughout his employment. David assumed his former organization’s coverage might cowl him, however the health facility’s coverage handiest protected modern employees.

Without tail insurance or private malpractice coverage, David had to lease personal suggest at his personal expense. The health facility’s lawyers shared documentation from David’s employment however supplied no direct protection for him individually. David ultimately negotiated an agreement requiring him to pay $15,000 out of pocket plus $28,000 in felony fees. An occurrence-primarily based totally private coverage bought throughout his employment might have protected this declare entirely

Common Myths about Nurse Malpractice Insurance

Myth: Carrying Insurance Makes You a Target for Lawsuits

Some nurses agree with that having non-public malpractice coverage makes them much more likely to be sued due to the fact plaintiffs` lawyers specially goal insured defendants. This delusion persists in spite of no proof helping it. Plaintiffs’ lawyers haven’t any manner of understanding which person nurses bring non-public coverage earlier than submitting court cases, so it can’t have an impact on their concentrated on decisions.

The fact is that court cases call nurses primarily based totally on their involvement in affected person care, now no longer their coverage status. Attorneys look at coverage insurance after submitting suits, now no longer earlier than. Additionally, the substantial majority of malpractice claims settle as opposed to going to trial, and having good enough coverage definitely enables affordable settlements that guard your property and reputation.

Myth: Good Nurses Don’t Need Malpractice Insurance

Being a skilled, careful, conscientious nurse doesn`t defend you from court cases. Medical malpractice is a felony process, now no longer a nursing competency evaluation. Patients can sue any healthcare issuer for any reason, and plenty of court cases towards nurses contain conditions in which the nurse furnished suitable care however the affected person skilled terrible results because of sickness progression, medical doctor decision-making, or elements past nursing control.

Even whilst you are absolutely blameless, you continue to want felony protection, and that protection charges cash whether or not you are in the long run located dependable or now no longer. Malpractice coverage covers protection charges no matter merit that is frequently its maximum precious benefit.

Myth: My Employer Will Always Defend Me

Employers have a felony responsibility to their shareholders and stakeholders to limit institutional legal responsibility and charges. When protecting you in my opinion conflicts with defensive the organization, the medical institution will prioritize institutional pastimes each time. This isn’t always malicious; it is virtually the fact of institutional felony strategy.

Additionally, many employers require nurses to signal agreements declaring they apprehend corporation insurance is number one coverage for the organization and makes no ensures approximately character insurance. Reading those agreements cautiously exhibits that hospices explicitly disclaim obligation for character nurse protection in lots of conditions.

Myth: Malpractice Insurance Is Too Expensive

At approximately $one hundred to $a hundred and fifty yearly for widespread insurance, nurse malpractice coverage charges much less than maximum nurses spend month-to-month on espresso or streaming services. It represents much less than one percentage of a mean RN salary. The go back on funding in phrases of economic safety and peace of thoughts is fantastically excessive as compared to the minimum value.

Many nurses spend extra yearly on CEU courses, expert enterprise memberships, or nursing footwear than they might on complete malpractice insurance. Framing it as “too expensive” displays a false impression of each the real value and the vast economic chance it protects against.

Myth: Claims-Made Coverage Isn`t Worth the Tail Coverage Cost

While tail insurance does constitute a vast fee at retirement or whilst leaving claims-made coverage, the yearly financial savings for the duration of your profession regularly exceed the tail value. If claims-made insurance charges $one hundred yearly as compared to $one hundred twenty for incidence insurance, over a 30-yr profession you save $600. Tail insurance usually charges 1.five to two instances your very last annual premium, or approximately $a hundred and fifty to $200.

Additionally, in case you keep claims-made insurance with the identical insurer at some stage in your profession, you by no means pay for tail insurance due to the fact your very last coverage year covers all previous years’ incidents. The tail most effective turns into essential whilst switching insurers or retiring with claims-made insurance.

Special Considerations for Advanced Practice Nurses

Nurse practitioners, medical nurse specialists, licensed registered nurse anesthetists, and authorized nurse midwives face notably better malpractice publicity than group of workers nurses because of their extended scope of exercise, expanded autonomy, prescriptive authority, and better degree of unbiased decision-making. This expanded publicity calls for better insurance limits and greater specialized coverage features.

Standard insurance for superior exercise nurses generally begins off evolved at $1 million in keeping with incident and $three million mixture, with many APNs carrying $2 million in keeping with incident and $6 million mixture insurance. CRNAs and nurse midwives, practicing in mainly high-hazard specialties, frequently carry $three million in keeping with incident insurance or better. The extra top rate for those better limits stays remarkably affordable, generally $three hundred to $800 yearly relying on uniqueness and exercise location.

Advanced exercise nurses ought to make sure their malpractice guidelines especially cowl their extended scope consisting of prescriptive authority, unbiased exercise inside their state`s scope of exercise laws, medical institution privileges and credentialing, telemedicine offerings if applicable, and insurance for all exercise places consisting of satellite TV for pc clinics or more than one exercise sites.

Many APNs in unbiased or institution personal exercise buy employment practices legal responsibility coverage similarly to malpractice insurance. This extra coverage covers employment-associated claims like wrongful termination, discrimination, harassment, or salary disputes that malpractice coverage excludes. The mixture of malpractice and employment practices legal responsibility coverage gives complete safety for exercise owners.

How to Use Your Malpractice Insurance Effectively

Immediate Response to Incidents

When an unfavorable event occurs, your first priority is affected character safety and appropriate clinical response. Once the immediately scenario stabilizes, document thoroughly and objectively with inside the clinical record, that specialize in facts without admitting fault or speculating about causes. Notify your charge nurse or supervisor following clinic incident reporting procedures.

Contact your malpractice insurance issuer inner 24 to 48 hours to report the incident despite the fact that you`re uncertain whether or not or now no longer it`s going to result in a claim. Most insurers provide nurse chance manage specialists who can guide your documentation and help you understand your obligations. This early notification starts off evolved a documentation direction and ensures you can now no longer face coverage denial later for failure to report timely.

Responding to Legal Documents

If you bought a lawsuit, subpoena, deposition notice, or any legal document related to your nursing practice, contact your malpractice insurance issuer at once in advance than taking any action. Do now no longer respond to legal documents, communicate the case with patients or personal family members, or try to cope with the scenario independently. Insurance hints mainly require that you notify them and allow them to control legal responses.

Your insurer will assign a criminal expert professional in nursing malpractice safety who will cope with all legal communications, court docket filings, and negotiations for your behalf. Follow your criminal expert’s guidance completely, which includes now no longer discussing the case with colleagues, now no longer posting about it on social media, and now no longer seeking to contact the plaintiff or their attorneys directly.

Leveraging Risk Management Resources

Most malpractice coverage vendors provide full-size danger control sources blanketed together along with your coverage. These usually consist of persevering with schooling publications on documentation, danger reduction, and felony issues; session hotlines for questions on precise medical situations; coverage and manner reviews; and courses overlaying modern-day malpractice traits and prevention strategies.

Use those sources proactively instead of awaiting issues to arise. Taking a documentation direction thru your insurer`s persevering with schooling portal may save you a lawsuit years later through enhancing your charting practices. Consulting the danger control hotline whilst dealing with an ethically complicated scenario affords professional steering that protects you legally even as assisting suitable affected person care.

Frequently Asked Questions

Does my employer’s malpractice insurance really not cover me personally?

Your enterprise`s coverage covers you most effective whilst you are performing inside your activity obligations as their worker and most effective whilst you continue to be hired there. The insurance is designed to guard the medical institution from legal responsibility, with character nurse insurance being incidental. If the medical institution’s felony approaches calls for arguing which you acted outdoor coverage or past your scope to shift legal responsibility far from the institution, their lawyers will make that argument although it harms your protection. Additionally, enterprise insurance excludes country board proceedings, off-responsibility incidents, and claims made after employment ends. Personal coverage fills these kinds of gaps.

Can I be sued individually even supposing I accompanied all regulations perfectly?

Yes, absolutely. Anyone can document a lawsuit making any allegation irrespective of whether or not you sincerely did whatever wrong. Having a lawsuit filed in opposition to you isn’t a dedication of guilt or legal responsibility, it absolutely way a person has made accusations in felony form. Many complaints in opposition to nurses are subsequently brushed off or resolved with inside the nurse’s choose, however protecting yourself via that method expenses tens of heaps of bucks whether or not you are in the long run determined innocent or now no longer. Your malpractice coverage can pay in your protection irrespective of merit.

What’s the distinction among malpractice coverage and legal responsibility coverage?

Professional legal responsibility coverage and malpractice coverage are phrases for the equal product. Both talk to insurance shielding healthcare experts from claims of negligence or mistakes in expert exercise. General legal responsibility coverage is special and covers non-expert incidents like slip-and-fall accidents, belongings harm, or accidents going on to your enterprise premises. As a nurse, you want expert legal responsibility (malpractice) coverage, now no longer well known legal responsibility coverage.

If I paintings consistent with diem at a couple of hospitals, do I want separate regulations for each?

No, one non-public malpractice coverage covers you in any respect your employment places and for all of your expert nursing activities. When you follow for insurance, you may list your number one enterprise and may suggest which you paintings consistent with Diem or a couple of positions. The unmarried coverage covers all expert nursing paintings you carry out anywhere. This is sincerely one of the most powerful arguments for non-public insurance, due to the fact counting on a couple of enterprise a regulation creates complexity and capability gaps that one non-public coverage eliminates.

Will having a lawsuit on my document spoil my nursing career?

Being named in a lawsuit would not routinely harm your career, as complaints are lamentably not unusual place in healthcare. What topics are the final results and the way you deal with the situation? Cases which are brushed off, resolved via agreement without admission of fault, or determined to your choose commonly have minimum long-time period impact. License programs ask approximately subject and crook history, now no longer each lawsuit you’ve got been concerned in. Maintain your professionalism, cooperate absolutely together along with your coverage company’s protection, and examine from the enjoy to enhance your exercise going forward.

Conclusion: Protecting Your Career and Financial Future

The query isn`t whether or not you are a great nurse or whether or not you may ever make a critical mistake. The query is whether or not you may have enough money to shield yourself whilst a person questions your care, disputes your judgment, or claims you induced damage even while you supplied suitable, equipped nursing care. At approximately $12 in keeping with month, private malpractice coverage is the unmarried maximum value-powerful expert funding you may make.

Your nursing license represents years of education, scientific training, and ongoing expert development. Your private property constitute many years of labor and monetary planning. An unmarried lawsuit without ok coverage insurance can damage each in months. The small annual value of complete malpractice coverage protects the entirety you’ve got constructed and affords peace of thoughts that helps you to cognizance on affected person care in preference to regular fear approximately legal responsibility exposure.

Don’t depend on myths, assumptions, or indistinct assurances from employers approximately insurance. Take duty on your personal expert safety via way of means of buying private malpractice coverage from a good provider. Review your insurance yearly to make certain it stays suitable on your exercise putting and activities. Keep your coverage records without delay available and recognize your reporting obligations.

The nurses, who exercise with confidence, endorse correctly for his or her patients, and sleep peacefully at night time are folks who understand they may be covered each clinically and legally. Join them via way of means of making malpractice coverage a non-negotiable a part of your expert exercise.

Next: Read our complete manual on “How to Choose the Best Malpractice Insurance for Nurses — 2025 Provider Comparison” to discover the appropriate coverage on your unique scenario and budget.

Web Story:

Malpractice Insurance for Nurses – Visual Guide

Related Post:

https://nurseseducator.com/best-malpractice-insurance-for-nurses-in-2025/

Web Story:

https://nurseseducator.com/web-stories/malpractice-insurance-for-nurses-web-story/

Read More:

https://nurseseducator.com/didactic-and-dialectic-teaching-rationale-for-team-based-learning/

https://nurseseducator.com/high-fidelity-simulation-use-in-nursing-education/

First NCLEX Exam Center In Pakistan From Lahore (Mall of Lahore) to the Global Nursing

Categories of Journals: W, X, Y and Z Category Journal In Nursing Education

AI in Healthcare Content Creation: A Double-Edged Sword and Scary

Social Links:

https://www.facebook.com/nurseseducator/

https://www.instagram.com/nurseseducator/

https://www.pinterest.com/NursesEducator/

https://www.linkedin.com/company/nurseseducator/

https://www.linkedin.com/in/nurseseducator/

https://www.researchgate.net/profile/Afza-Lal-Din

https://scholar.google.com/citations?hl=en&user=F0XY9vQAAAAJ

I have seen lots of useful issues on your web-site about pc’s. However, I’ve the viewpoint that notebook computers are still more or less not powerful enough to be a sensible choice if you frequently do jobs that require many power, just like video enhancing. But for web surfing, microsoft word processing, and quite a few other popular computer functions they are perfectly, provided you can’t mind your little friend screen size. Appreciate sharing your thinking.

You made some respectable points there. I seemed on the web for the issue and found most people will go along with together with your website.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**pineal xt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.