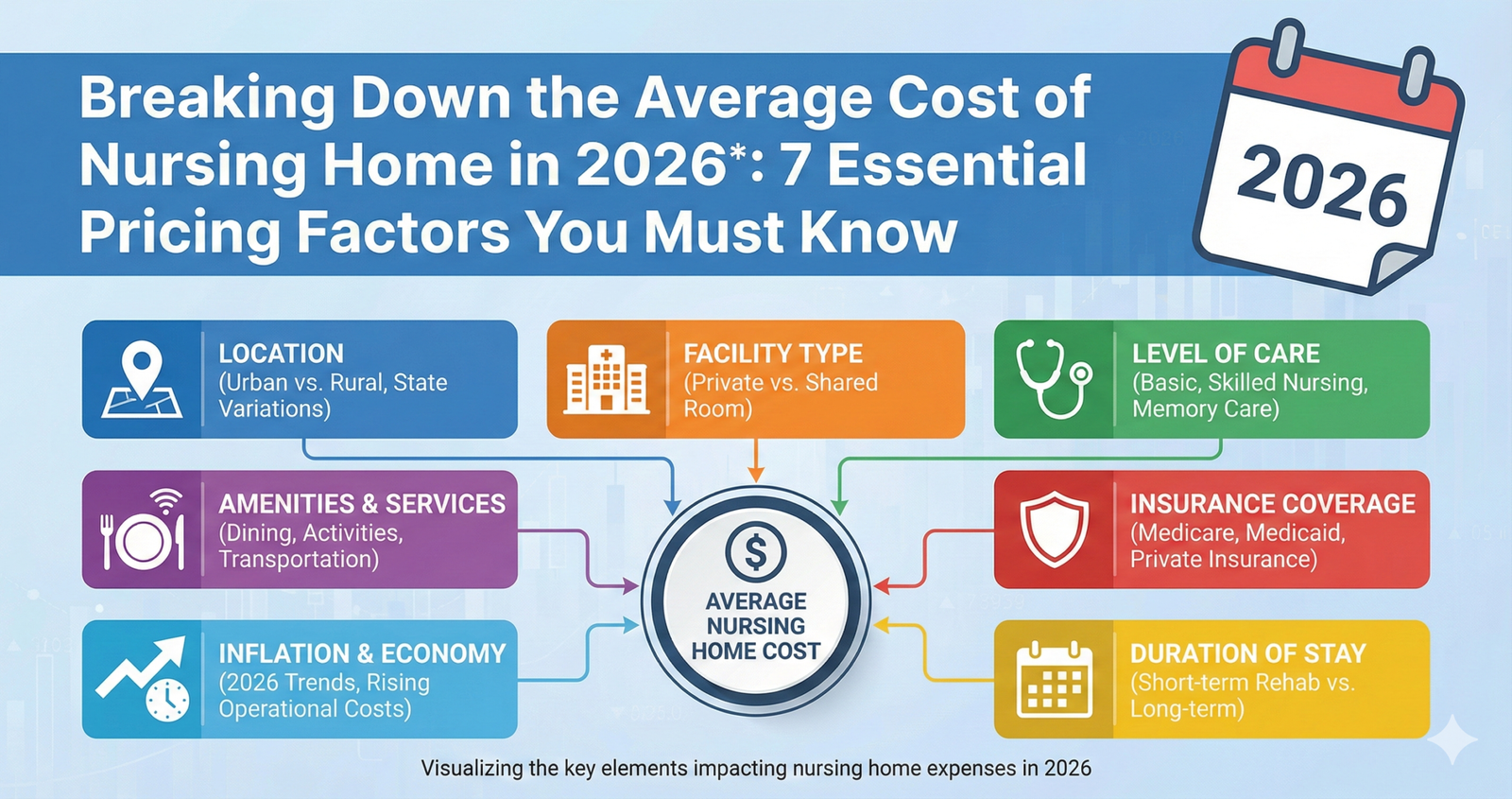

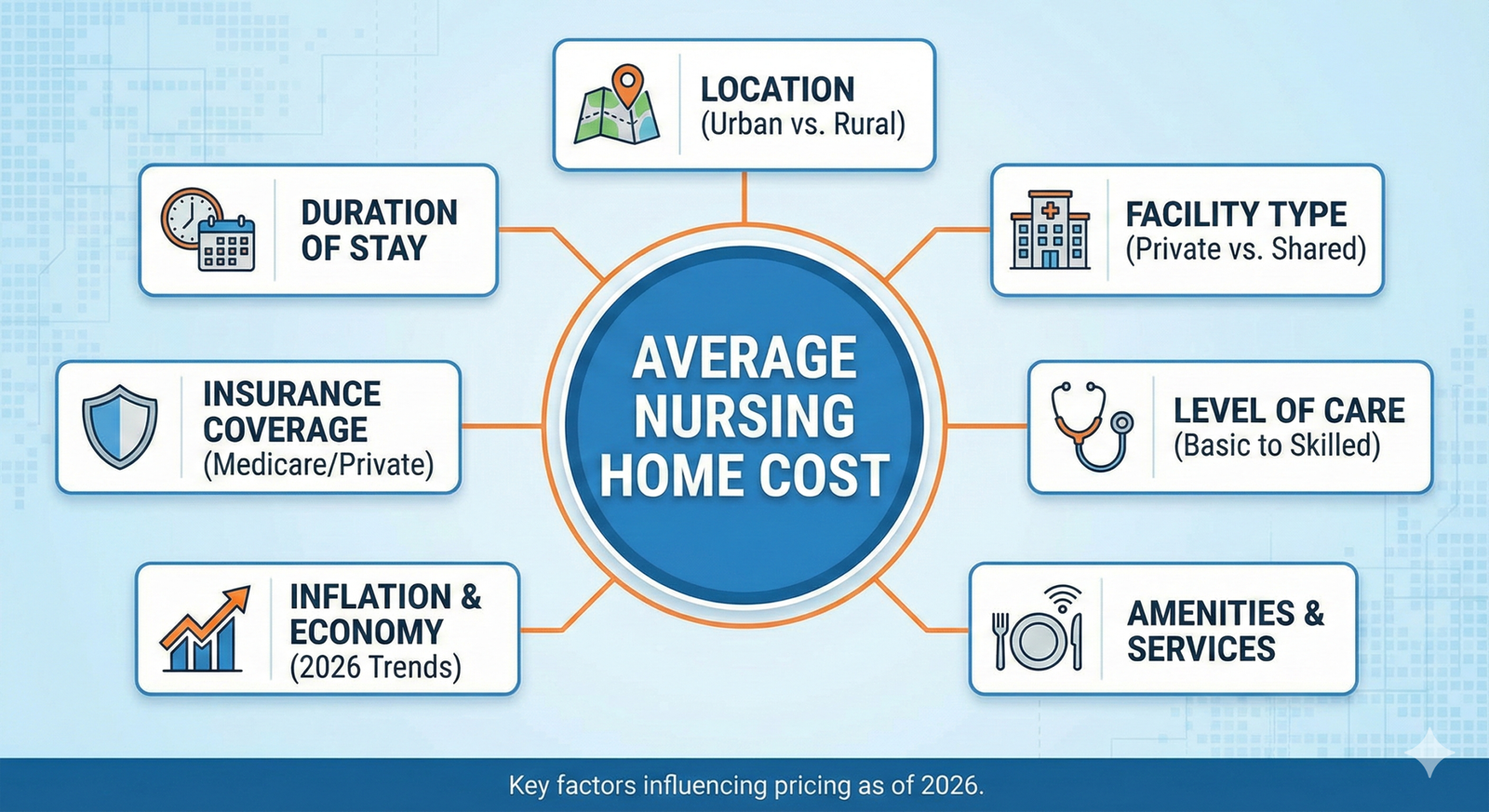

Discover Breaking Down the Average Cost of Nursing Home in 2026: 7 Essential Pricing Factors You Must Know? Common fee of nursing houses in 2026. Explore kingdom-via way of means of-kingdom pricing, hidden fees, price options, and money-saving techniques for long-time period care making plans.

7 Essential Pricing Factors You Must Know: Breaking Down the Average Cost of Nursing Home in 2026

Introduction

The panorama of long-time period care expenses maintains to shift dramatically, with nursing domestic charges attaining exceptional tiers in 2026. According to Genworth`s 2026 Cost of Care Survey, the countrywide median fee for a semi-non-public nursing domestic room now stands at 9 thousand 4 hundred greenbacks month-to-month, representing a 4.8% boom from 2024. The Centers for Medicare and Medicaid Services (CMS) reviews that about 1.3 million Americans presently are living in nursing centers, with expenses ingesting giant quantities of retirement savings.

The American Health Care Association initiatives that via way of means of 2030, call for nursing domestic beds will boom via way of means of 27% as toddler boomers age, doubtlessly use expenses even better. Understanding the complete economic implications of nursing domestic care is critical for households going through those decisions, as insufficient plans can result in economic devastation and restricted care options.

National Average Costs: The 2026 Baseline

Semi-Private Room Rates

Semi-non-public rooms, wherein citizens proportion residing area with one roommate, constitute the maximum affordable nursing domestic option. Genworth’s 2026 statistics suggests the countrywide median month-to-month fee is 9 thousand 4 hundred greenbacks, translating to about a hundred twelve thousand 8 hundred greenbacks yearly. This represents 3 hundred 13 greenbacks day by day for simple custodial care, meals, and scientific supervision.

The Medicare Payment Advisory Commission (MedPAC) notes that semi-non-public costs have accelerated continually at three-5% yearly over the last decade, outpacing trendy inflation costs and growing affordability demanding situations for middle-profits households missing complete long-time care coverage.

Private Room Rates

Private rooms supplying character residing quarters command top class pricing, with the 2026 countrywide median attaining 10000 9 hundred greenbacks month-to-month or about 130 thousand 8 hundred greenbacks yearly. This represents 3 hundred sixty-3 greenbacks day by day 16% top class over semi-non-public resorts.

The desire for non-public rooms has grown substantially, with the National Investment Center for Seniors Housing and Care (NIC) reporting that 68% of households request non-public resorts while available pushed via way of means of dignity considerations, contamination manage possibilities heightened via means of COVID-19 experiences, and preference for personalized residing environments.

Regional Variation Analysis

Geographic area dramatically impacts nursing domestic expenses, growing disparities exceeding 200% among maximum and lowest-fee states. The MetLife Mature Market Institute’s studies demonstrate that coastal states and fundamental metropolitan regions continually display accelerated pricing.

Urban centers rate 25-40% extra than rural opposite numbers in the identical kingdom, reflecting better operational expenses which include group of workers’ wages, actual property values, and regulatory compliance charges. Understanding local versions proves critical for households thinking about interstate relocation to lessen long-time period care charges even as retaining nice standards.

State-by-State Cost Breakdown

Highest-Cost States

Alaska leads the country with the best nursing domestic prices, averaging fourteen thousand 100 greenbacks month-to-month for semi-personal rooms in line with 2026 data. Hawaii follows at 13 thousand 8 hundred greenbacks, whilst Massachusetts, Connecticut, and New Jersey spherical out the pinnacle 5 with month-to-month charges exceeding twelve thousand greenbacks.

These improved prices replicate a couple of elements which include better minimal salary requirements, stringent nurse-to-affected person ratios mandated with the aid of using nation regulations, improved assets prices, and confined mattress availability growing aggressive pricing environments. The Scan Foundation notes that citizens in high-price states spend their lifestyles financial savings 40% quicker than the ones in mild-price areas.

Most Affordable States

Oklahoma gives the country`s lowest nursing domestic prices at six thousand 9 hundred greenbacks month-to-month for semi-personal accommodations, accompanied with the aid of using Missouri, Mississippi, Louisiana, and Arkansas, all beneathneath seven thousand 5 hundred greenbacks month-to-month.

These decreased prices correlate with decreased operational expenses, decreased salary requirements, and extra mattress availability relative to demand. However, the American Association of Homes and Services for the Aging cautions that decrease prices do not always imply inferior care first-class, as many centers in low-cost states hold amazing requirements whilst taking advantage of favorable financial conditions.

Mid-Range Cost States

The majority of states cluster across the 9 thousand to 10 thousand greenback month-to-month variety, which include states like Texas, Florida, Arizona, and North Carolina. These areas provide mild pricing with various facility alternatives balancing price and first-class considerations. The National Center for Assisted Living emphasizes that mid-variety markets frequently offer gold standard price propositions, combining affordable pricing with aggressive first-class requirements pushed with the aid of wholesome marketplace dynamics and regulatory frameworks helping each affordability and care excellence.

Understanding What’s Included in Base Rates

Core Services and Amenities

Base nursing domestic charges generally cowl room and board, 3 food day by day plus snacks, house responsibilities and laundry services, primary utilities, 24-hour nursing supervision, help with sports of day by day residing which include bathing, dressing, toileting, and remedy management. The Centers for Medicare and Medicaid Services mandates minimal provider requirements for licensed centers, making sure citizens obtain well enough nutrition; secure environments, and suitable staffing levels. However, the definition of “primary care” varies drastically among centers, making cautious settlement overview crucial earlier than admission.

Medical and Nursing Care Coverage

Skilled nursing centers offer clinical offerings which include wound care, post-surgical restoration support, bodily remedy, occupational remedy, and speech remedy as medically necessary. Licensed sensible nurses and registered nurses supply care below health practitioner oversight, with clinical administrators coordinating remedy plans. The American Nurses Association emphasizes that nursing domestic staffing ratios without delay effect care quality, with centers keeping better nurse-to-resident ratios normally charging top rate fees however handing over advanced outcomes. Base fees commonly cowl ordinary clinical supplies; however specialized gadgets may also incur extra expenses.

Activities and Social Programming

Quality nursing houses include interest programming selling cognitive engagement, social interaction, and bodily mobility. The Pioneer Network`s subculture extrade motion emphasizes person-focused care techniques changing institutional fashions with homelike environments fostering resident autonomy and dignity.

Base fees normally consist of organization sports like exercising classes, arts and crafts, tune programs, spiritual offerings, and enjoyment events. However, man or woman remedy sessions, specialized programs, or off-web website online tours may also require supplementary bills relying on facility policies.

Hidden Costs and Additional Fees

Community Fees and Entry Deposits

Many centers price non-refundable network charges starting from 1000 to 5 thousand greenbacks protecting administrative processing, room preparation, and preliminary assessments. Some persevering with care retirement groups require vast access deposits starting from fifty thousand to 5 hundred thousand greenbacks, aleven though those can be partly refundable upon departure. The American Seniors Housing Association recommends very well know-how deposit terms, refund situations, and the way charges follow in the direction of month-to-month charges earlier than making monetary commitments.

Level of Care Assessments and Upcharges

Facilities an increasing number of put in force tiered pricing fashions in which base fees cowl minimum assistance, with extra expenses for better care needs. Residents requiring vast mobility assistance, specialized dementia care, or common clinical interventions may also incur supplementary charges starting from 5 hundred to a few thousand greenbacks month-to-month. The National Consumer Voice for Quality Long-Term Care warns that those variable pricing systems can create price range uncertainty, specifically as resident situations become worse over time, making most price know-how critical throughout preliminary planning.

Medical Supplies and Equipment

While simple clinical resources are generally included, specialized gadgets like specialized wheelchairs, pressure-relieving mattresses, diabetic resources past general provisions, oxygen equipment, or specialized feeding structures may also generate extra fees. Prescription medicines constitute some other big fee class commonly now no longer protected in base prices. The Medicare Rights Center reviews that nursing domestic citizen’s common 4 hundred to 8 hundred bucks’ month-to-month in medicine fees, developing full-size extra monetary burden past facility charges.

Personal Care Items and Services

Personal toiletries, clothing, salon offerings, cable television, phone offerings, and net get entry to generally require separate payment. Some centers fee for transportation to clinical appointments, specialized nutritional lodges past general menus, or visitor meal offerings whilst own circle of relatives visits. These reputedly minor costs can gather to numerous hundred bucks month-to-month. The AARP Foundation recommends budgeting an extra 15-20% past base prices to cowl those incidental fees realistically.

Payment Options and Financial Planning Strategies

Medicare Coverage and Limitations

Medicare offers restricted nursing domestic insurance completely for professional nursing care following hospitalization, overlaying as much as one hundred days in line with advantage period. Days 1-20 are completely protected, even as days 21-one hundred require day by day copayments of hundred bucks in 2026. Importantly, Medicare does now no longer cowl long-time period custodial care, which constitutes the bulk of nursing domestic stays.

The Kaiser Family Foundation emphasizes that Medicare can pay for simplest 15% of overall nursing domestic fees nationally, with the common Medicare-protected live lasting simply 28 days, leaving households answerable for long-time period costs.

Medicaid Eligibility and Coverage

Medicaid serves because the number one payer for 62% of nursing domestic citizens in keeping with CMS data, overlaying each clinical and custodial take care of financially eligible people. Eligibility calls for assembly strict earnings and asset limits—generally month-to-month earnings below seven-hundred thousand bucks and countable property below thousand bucks for people in 2026.

Married couples can guard spousal property and earnings via provisions just like the Community Spouse Resource Allowance. The National Academy of Elder Law Attorneys notes that strategic Medicaid planning, even as criminal and moral whilst nicely executed, calls for expert steerage to navigate complicated guidelines even as retaining own circle of relative’s resources.

Long-Term Care Insurance

Long-time period care coverage rules bought earlier than age sixty five can substantially offset nursing domestic fees, aleven though simplest 7.five million Americans preserve such insurance in keeping with the American Association for Long-Term Care Insurance. Policies range dramatically in phrases of day-by-day advantage amounts, advantage periods, removal periods, and inflation protection.

Premiums have risen substantially, with common annual fees for complete rules exceeding 3 thousand bucks for people of their mid-50s. The National Association of Insurance Commissioners recommends comparing whether or not charges plus funding returns on stored charges exceed ability blessings given character fitness profiles and own circle of relative’s durability patterns.

Veterans Benefits

Veterans and surviving spouses can also additionally qualify for Aid and Attendance blessings imparting up to 2 thousand 3 hundred greenbacks month-to-month closer to nursing domestic fees in 2026. The Department of Veterans Affairs gives extra applications which include network nursing houses, country veterans’ houses, and VA nursing domestic care centers.

Eligibility calls for wartime service, incapacity or age-associated care desires, and assembly profits and asset thresholds. The Veterans Health Administration reviews that those blessings continue to be considerably underutilized, with simplest 30% of eligible veterans getting access to be had long-time period care support.

Private Pay and Asset Liquidation

Approximately 28% of nursing domestic citizens to begin with pays privately the use of retirement savings, domestic equity, or funding proceeds. Financial advisors that specialize in elder care endorse preserving liquid property enough for 2-three years of nursing domestic fees earlier than transitioning to Medicaid, as this presents extra facility desire and negotiating power.

Reverse mortgages, existence coverage acceleration, and annuity conversions constitute techniques for producing nursing domestic price resources, aleven though every contains wonderful tax implications and long-time period effects requiring expert economic guidance.

Factors Influencing Individual Costs

Care Acuity and Medical Complexity

Residents requiring specialized take care of situations like superior Alzheimer`s disease, Parkinson’s disease, or complicated clinical desires which includes ventilator dependence, feeding tubes, or wound control pay extensively more. Memory care devices particularly designed for dementia sufferer’s price 20-30% charges over preferred nursing care, reflecting specialized education requirements, superior protection capabilities, and decrease staff-to-resident ratios.

Research posted with inside the Journal of the American Geriatrics Society demonstrates robust correlation among care depth and month-to-month fees, with citizens with inside the maximum acuity quintile paying double baseline costs.

Facility Quality and Amenities

The Centers for Medicare and Medicaid Services costs nursing houses the use of a five-supermegacelebrity nice device primarily based totally on fitness inspections, staffing levels, and nice measures. Five-supermegacelebrity centers command top rate pricing averaging 25% above one-supermegacelebrity centers with inside the equal geographic area.

Amenities like personal bathrooms, up to date interiors, restaurant-fashion dining, considerable hobby programming, and top rate region capabilities power pricing variations. The Consumer Reports Guide to Long-Term Care emphasizes that better fees do not ensure higher care, however centers with robust nice indicators, fine own circle of relative’s reviews, and good enough staffing typically justify mild top rate pricing via advanced outcomes.

Length of Stay Considerations

The common nursing domestic live period is 835 days in step with the National Center for Health Statistics, aleven though vast variant exists. Short-time period rehabilitation remains common 28 days, at the same time as long-time period custodial citizen’s common 2.5 years. Some centers provide modest month-to-month price reductions for citizens committing to prolonged remains or paying numerous months in advance. However, the Alzheimer`s Association notes that making plans for longer-than-common remains proves financially prudent, as dementia sufferers often live in centers for 3-five years or longer.

Cost Comparison: Nursing Homes vs. Alternative Care Options

Assisted Living Facilities

Assisted residing gives a much less in depth care opportunity averaging 4 thousand 8 hundred greenbacks month-to-month nationally in 2026 in step with Genworth data—about 50% much less than nursing houses. Assisted residing fits people requiring assistance with everyday sports however now no longer professional nursing supervision.

However, the National Investment Center for Seniors Housing and Care cautions that citizens frequently subsequently require nursing domestic switch as situations deteriorate, with assisted residing serving as intermediate in place of everlasting solution. Understanding switch triggers in assisted residing contracts prevents surprising disruptions and monetary surprises.

In-Home Care Services

Home fitness aide offerings fee about twenty-8 greenbacks hourly in 2026, with full-time care requiring more than one every day visits totaling six thousand to 8 thousand greenbacks month-to-month for complete support—much less than nursing houses however supplying restricted scientific supervision.

Many households to begin with pick out domestic take care of familiarity and independence benefits, transitioning to institutional care whilst protection concerns, caregiver burnout, or scientific complexity necessitate 24-hour expert oversight. The Family Caregiver Alliance reviews that casual own circle of relative’s caregiving gives monetary prices exceeding 4 hundred seventy billion greenbacks annually, aleven though this creates significant physical, emotional, and monetary burden on own circle of relatives’ members.

Continuing Care Retirement Communities

CCRCs provide continuum care fashions combining unbiased residing, assisted residing, and nursing care inside unmarried campuses. Entry charges variety from a hundred thousand to 1,000,000 greenbacks plus month-to-month charges from 3 thousand to 5 thousand greenbacks.

This version gives assured nursing domestic get right of entry to without extra access charges whilst needed, supplying fee predictability and care continuity. The Leading Age business enterprise emphasizes that CCRCs match financially snug seniors searching for complete aging-in-location solutions, aleven though prematurely prices create limitations for plenty households.

Strategies for Managing and Reducing Costs

Early Planning and Asset Protection

The National Care Planning Council recommends starting long-time period care making plans at age 50, permitting time for coverage buy at affordable charges, asset repositioning, and own circle of relative’s discussions decreasing crisis-pushed decisions. Irrevocable trusts, strategic gifting inside Medicaid look-again periods, and existence property preparations constitute felony strategies protective own circle of relative’s property whilst preserving destiny Medicaid eligibility.

However, elder regulation lawyers emphasize that those techniques require implementation years earlier than nursing domestic admission, as Medicaid`s five-12 months look-again duration scrutinizes asset transfers for wrong spend-down avoidance.

Facility Negotiation Tactics

Private-pay citizens own negotiating leverage, specifically in markets with to be had capacity. Requesting company fee matching, leveraging veteran status, or negotiating decreased charges in change for prematurely multi-month bills can yield 5-15% financial savings. The National Consumer Voice for Quality Long-Term Care shows focusing negotiations on hidden prices and blanketed offerings instead of base charges, as centers hold greater flexibility in ancillary prices than posted room charges.

Utilizing Tax Deductions and Benefits

Nursing domestic expenses for persistent infection qualify as scientific cost deductions on federal tax returns, doubtlessly producing sizeable tax financial savings for households listing deductions. When scientific prices exceed 7.5% of adjusted gross income, the extra will become deductible. Additionally, Health Savings Accounts and Flexible Spending Accounts will pay for certified long-time period care prices tax-free. The Internal Revenue Service Publication 502 gives complete guidance, aleven though complicated conditions warrant session with tax experts that specialize in elder care to maximize to be had benefits.

Quality vs. Cost Considerations

Evaluating Value Beyond Price

The Nursing Home Compare device on Medicare.gov gives obvious fine facts allowing households to evaluate fee propositions objectively. Key signs consist of staffing hours in line with resident day, fitness inspection deficiencies, resident and own circle of relatives delight scores, and fine measures like stress ulcer charges and antipsychotic medicinal drug usage. Research posted in Health Affairs demonstrates that centers with better staffing ratios—even at top class expenses—supply higher consequences together with decrease hospitalization charges, decreased mortality, and better own circle of relative’s delight, doubtlessly offsetting better base charges via advanced care fine.

Warning Signs of Underpriced Facilities

Unusually low pricing may also imply regarding fine compromises together with insufficient staffing, deferred maintenance, restricted programming, or monetary instability threatening facility operations. The Office of Inspector General identifies chronic understaffing because the maximum sizeable fine difficulty in nursing homes, with centers supplying drastically below-marketplace charges frequently reaching value financial savings via decreased employees instead of operational efficiency.

The AARP Nursing Home Checklist emphasizes that complete facility assessment together with unannounced visits, resident interviews, and regulatory records evaluation prevents highly priced errors in facility selection.

Future Cost Projections and Planning

Anticipated Trends Through 2030

The Congressional Budget Office tasks nursing domestic fees will maintain growing 4-6% yearly thru 2030, appreciably exceeding fashionable inflation. Contributing elements consist of staff shortages riding salary increases, regulatory upgrades enhancing nice requirements however growing operational fees, and developing call for from getting old populations straining capacity. The Urban Institute estimates that with the aid of using 2030, people turning sixty-five will face 70% opportunity of requiring long-time period care services, with common fees exceeding 100 fifty thousand bucks yearly, underscoring urgency for complete monetary making plans.

Inflation Protection Strategies

Financial planners focusing on retirement advise incorporating 5% annual inflation elements into long-time period care projections. Investment techniques balancing boom ability with capital maintenance turn out to be crucial, as nursing domestic fees can quick exhaust inadequately deliberate retirement portfolios. The National Institute on Aging shows that people must plan for nursing domestic fees eating 75-100% of Social Security and pension income, requiring good sized extra assets from investments, coverage, or own circle of relatives assist to preserve monetary balance at some point of prolonged care needs.

Conclusion

Navigating nursing domestic fees in 2026 calls for complete knowledge of pricing structures, geographic versions, fee alternatives, and long-time period monetary implications. The country wide common of 9 thousand 4 hundred bucks’ month-to-month for semi-non-public care and 10000 9 hundred bucks for non-public rooms represents good sized monetary duties which could unexpectedly use up retirement financial savings without right making plans.

Geographic area dramatically impacts fees, with versions exceeding hundreds of percentages among states, at the same time as hidden fees, care degree upcharges, and clinical costs upload tremendous quantities past base rates. Payment alternatives which include Medicare`s restricted coverage, Medicaid’s means-examined blessings, long-time period care coverage, and veterans blessings every provide wonderful blessings and boundaries requiring cautious evaluation. Families have to stability value issues in opposition to nice indicators, such as ok staffing ratios, nice inspection records, and sturdy own circle of relative’s pride rankings justify affordable top rate pricing through advanced care outcomes.

Beginning long-time period care making plans at age fifty through coverage purchase, asset safety techniques, and own circle of discussions prevents crisis-pushed selections that restrict alternatives and growth fees. Organizations just like the Centers for Medicare and Medicaid Services, National Consumer Voice for Quality Long-Term Care, and nearby Area Agencies on Aging offer precious assets supporting households navigate those complicated selections successfully at the same time as retaining dignity and monetary balance.

FAQs

FAQ 1: Does Medicare cover nursing home costs?

Medicare covers best short-time period professional nursing care following hospitalization for as much as a hundred days in line with advantage period, with complete insurance for days 1-20 and copayments for days 21-a hundred. Medicare does now no longer cowl long-time period custodial care, which represents maximum nursing domestic stays.

FAQ 2: How can I have the funds for nursing domestic care without draining my complete lifestyles savings?

Strategic making plans consisting of long-time period care coverage buy earlier than age 65, prison asset safety strategies applied years in advance, Medicaid making plans with elder regulation legal professional guidance, and utilizing veterans’ advantages for eligible people can hold own circle of relative’s sources at the same time as making sure pleasant care access.

FAQ 3: What is the distinction among professional nursing centers and nursing houses?

The phrases are frequently used interchangeably; aleven though professional nursing centers emphasize scientific and rehabilitative offerings with better nurse staffing ratios, at the same time as nursing houses may also consist of greater custodial care focus. Both offer 24-hour supervision and help with everyday dwelling activities.

FAQ 4: How do I locate pleasant nursing houses inside my budget?

Use Medicare.gov`s Nursing Home Compare device to assess pleasant ratings, behavior unannounced visits looking at workforce interactions and cleanliness, assessment inspection reports, communicate with contemporary citizens and families, and visit neighborhood Area Agency on Aging counselors who recognize local alternatives and pleasant reputations.

Read More:

https://nurseseducator.com/didactic-and-dialectic-teaching-rationale-for-team-based-learning/

https://nurseseducator.com/high-fidelity-simulation-use-in-nursing-education/

First NCLEX Exam Center In Pakistan From Lahore (Mall of Lahore) to the Global Nursing

Categories of Journals: W, X, Y and Z Category Journal In Nursing Education

AI in Healthcare Content Creation: A Double-Edged Sword and Scary

Social Links:

https://www.facebook.com/nurseseducator/

https://www.instagram.com/nurseseducator/

https://www.pinterest.com/NursesEducator/

https://www.linkedin.com/company/nurseseducator/

https://www.linkedin.com/in/afzalaldin/

https://www.researchgate.net/profile/Afza-Lal-Din

https://scholar.google.com/citations?hl=en&user=F0XY9vQAAAAJ