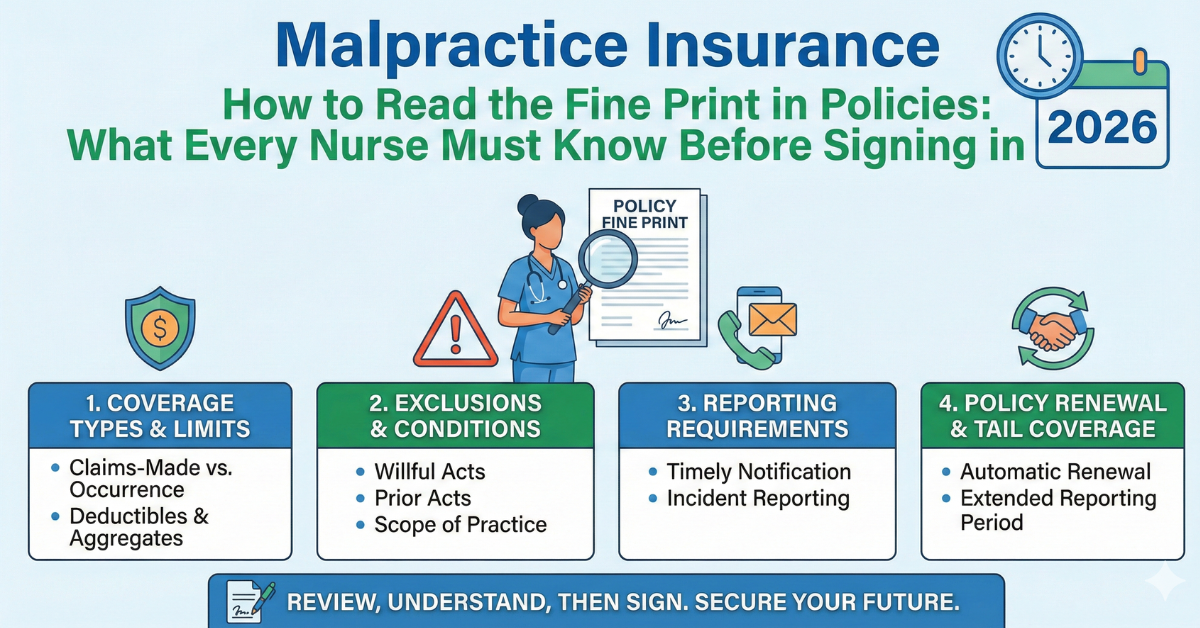

How to Read the Fine Print in Malpractice Insurance Policies: What Every Nurse Must Know Before Signing in 2026. To understand the fine print of a professional liability insurance policy, a nurse should focus on the types of coverage, limits, exclusions, and additional benefits to ensure comprehensive protection for her specific activity.

What Every Nurse Must Know Before Signing in 2026: How to Read the Fine Print in Malpractice Insurance Policies

You`re reviewing your new malpractice coverage, and the top class appears affordable at simply a hundred twenty greenbacks yearly for 1,000,000 greenbacks in insurance. The income consultant confident you it is complete safety that covers the whole lot you want as a running nurse. But buried in segment twelve, subsection C of the quality print is an exclusion clause declaring the coverage does not cowl claims springing up from telehealth services—and you have got been imparting digital affected person consultations for the beyond six months.

When a affected person documents a grievance approximately recommendation you gave at some stage in a video visit, you find out your million-greenback coverage is nugatory for this claim, leaving you in my opinion accountable for felony protection expenses which could exceed fifty thousand greenbacks even in case you are observed now no longer negligent.

This nightmare state of affairs occurs to nurses each 12 months due to the fact they failed to recognize the essential exclusions, limitations, and situations hidden of their malpractice coverage quality print. Learning to examine and recognize that information isn’t always pretty much shielding your assets—it is approximately making sure you in reality have the insurance you are buying whilst you want it most.

Quick Snapshot: Malpractice Policy Essentials

- Average Annual Premium for RNs: $100–$two hundred for $1M/$3M insurance

- Common Coverage Limits: $1 million according to occurrence / $three million aggregate (1M/3M)

- Most Dangerous Hidden Exclusion: Telehealth or digital care limitations

- Typical Deductible Range: $0–$2,500 according to claim

- Legal Defense Cost Average: $50,000–$150,000 even for instances you win

- Percentage of Nurses Without Personal Coverage: Approximately 40% depend completely on organization policies

- Average Settlement for Nursing Malpractice Claims: $225,000–$350,000 relying on specialty

- Tail Coverage Cost: 150%–300% of annual top class while leaving claims-made policies

What Malpractice Insurance Fine Print Really Means

The excellent print to your malpractice coverage is the distinctive felony language that defines precisely what’s and isn`t blanketed below your coverage. While advertising substances and income conversations recognition on insurance limits and low-priced premiums, the excellent print carries the unique terms, conditions, exclusions, definitions, and boundaries that decide whether or not your coverage will definitely guard you while you face a claim.

Insurance rules are felony contracts written via way of means of legal professionals to guard the coverage employer’s pursuits even as imparting insurance to policyholders. Every phrase topics in those documents, and apparently minor clauses can absolutely alternate whether or not you’ve got insurance in unique conditions. The excellent print is not blanketed to confuse you—it exists due to the fact coverage regulation calls for particular language defining the scope of insurance, and courts interpret those rules primarily based totally on their actual wording.

Understanding the excellent print method understanding the distinction among what you believe you studied you are shopping for and what you are definitely receiving. A coverage marketed as complete insurance might also additionally comprise dozens of exclusions that put off safety for not unusual place nursing conditions. The excellent print determines whether or not your coverage covers felony protection fees similarly to agreement quantities or if protection fees depend towards your general insurance limit. It specifies whether or not you are blanketed for incidents that befell throughout your coverage length irrespective of whilst claims are filed, or handiest for claims definitely filed even as your coverage is active.

Most nurses by no means study their whole coverage, depending alternatively on summaries supplied via way of means of income representatives or blessings administrators. This creates risky gaps in information that handiest turn out to be obvious whilst submitting a claim. The coverage employer has no duty to cowl conditions excluded with inside the excellent print, irrespective of what verbal assurances you acquired whilst shopping the coverage. Reading and information the excellent print earlier than you want insurance is the handiest manner to make sure you’ve got good enough safety on your unique nursing practice.

Why Understanding Your Policy Fine Print Is Critical

Malpractice coverage exists entirely to shield your economic property, expert reputation, and private wellbeing whilst sufferers allege negligence or damage out of your nursing care. However, this safety most effective materializes in case your coverage sincerely covers the precise scenario you`re facing. Misunderstanding your insurance creates a fake experience of protection that could have devastating consequences.

The Real Cost of Inadequate Coverage

When you face a malpractice declare without right coverage insurance, you are in my opinion chargeable for all criminal protection fees and any agreement or judgment quantities. Legal protection on my own generally fees fifty thousand to 100 fifty thousand greenbacks for sincere instances and might exceed 3 hundred thousand greenbacks for complicated litigation that is going to trial. These fees accrue no matter whether or not you are in the end discovered negligent or absolutely exonerated.

Most nurses do not have discretionary financial savings to cowl those criminal prices whilst preserving their ordinary residing prices. Defense lawyers require retainers in advance earlier than starting work, generally starting from 10000 to twenty-5 thousand greenbacks initially. Without coverage insurance, you can war to even steady criminal representation, leaving you trying to navigate complicated clinical malpractice litigation without certified counsel.

If a case proceeds to judgment towards you, agreement quantities or jury awards can attain loads of heaps or maybe tens of thousands and thousands of greenbacks relying at the severity of affected person damage. Your private property which includes domestic equity, retirement accounts, funding portfolios, and destiny profits come to be at risk of series efforts. Some states restriction salary garnishment, however judgment lenders can pursue property for many years in lots of jurisdictions, affecting your economic protection for the relaxation of your profession and probably into retirement.

License Protection and Professional Defense

Malpractice claims often cause parallel investigations through kingdom forums of nursing no matter criminal merit. While your malpractice coverage can also additionally offer criminal protection for the civil declare, many nurses do not comprehend their coverage won’t cowl administrative license protection proceedings. The best print generally clarifies whether or not license protection is included, excluded, or to be had most effective as a non-compulsory rider requiring extra premium.

License protection charges can variety from 5 thousand to thirty thousand greenbacks relying at the complexity of the board research and whether or not it proceeds to formal hearings. Losing your nursing license manifestly gets rid of your capacity to earn profits on your profession, making license protection insurance doubtlessly greater crucial than insurance for economic damages. Understanding whether or not your coverage consists of this safety calls for cautiously analyzing the satisfactory print sections on included criminal court cases and definitions of insured events.

Some guidelines encompass automated insurance for license protection, others provide it as a non-obligatory upgrade, and a few exclude it entirely. Without this insurance, you`ll pay out of pocket for specialized healthcare lawyers acquainted with nursing board court cases, become independent from the legal professional dealing with your malpractice civil case.

Employment and Credentialing Impact

Claims in opposition to you, despite the fact that in the end brushed off or settled without an admission of wrongdoing, should be disclosed on destiny employment applications, credentialing paperwork, and license renewal forms. How those claims are resolved and whether or not you had ok criminal illustration appreciably influences your expert destiny. Settling a declare without right protection due to the fact you lacked coverage insurance can create an everlasting black mark in your expert file that influences employment possibilities for decades.

Healthcare facilities, coverage credentialing panels, and licensing forums all evaluate your claims records whilst making choices approximately your expert privileges. Claims that display you had insufficient coverage insurance or represented yourself without recommend improve purple flags approximately your expert judgment and threat control practices. Proper coverage insurance tested via the satisfactory print offers credentialing committees with self-assurance which you take expert legal responsibility seriously.

Emotional and Mental Health Consequences

The mental effect of protecting a malpractice declare with out good enough coverage insurance is severe. The pressure of capability economic ruin, the complexity of navigating prison complaints with out right representation, and the uncertainty approximately your expert destiny create anxiety, depression, and burnout that influences each issue of your life. Many nurses dealing with claims document signs constant with post-disturbing pressure, courting difficulties, and attention of leaving the career entirely.

Having complete coverage insurance documented on your coverage great print gives peace of thoughts that lets in you to cognizance to your protection and keeps presenting affected person care as opposed to stressful approximately economic devastation. This emotional safety is one of the maximum precious however least mentioned blessings of really expertise you’re insurance.

Essential Fine Print Sections Every Nurse Must Understand

Coverage Limits and How They Actually Work

The insurance limits phase defines the most quantity your coverage business enterprise can pay for claims at some point of your coverage length. Standard nursing malpractice rules usually provide 1,000,000 bucks in keeping with incidence and 3 million bucks combination, normally written as one M scale down 3 M. Understanding what those numbers truly suggest is essential due to the fact they`re frequently misunderstood.

The in keeping with incidence restriction is the most the coverage business enterprise can pay for any unmarried declare or lawsuit towards you. If a affected person documents a declare alleging damage out of your nursing care, your insurer can pay as much as 1,000,000 bucks along with prison protection prices and any agreement or judgment, relying on how your coverage systems protection fee insurance. This restriction applies no matter what number of plaintiffs is involved, so an unmarried incident affecting a couple of sufferers nonetheless falls below the unmarried incidence restriction.

The combination restriction is the overall most the coverage business enterprise can pay for all claims at some point of your coverage length no matter what number of separate incidents occurs. If you face 3 separate claims at some point of your coverage year, your insurer can pay up to 3 million bucks general throughout all 3 claims. Once you have exhausted your combination restriction, you don’t have any last insurance although extra claims get up at some point of that coverage length.

The exceptional print specifies whether or not criminal protection expenses are paid further on your insurance limits or if protection expenses matter in opposition to your limits. This difference dramatically impacts your real protection. Policies with protection expenses further to limits offer extra complete insurance due to the fact the entire a million greenbacks stays to be had for settlements or judgments even after spending a hundred thousand greenbacks on criminal protection. Policies with protection expenses covered inside limits lessen your to be had agreement insurance via way of means of anything quantity became spent on criminal fees.

Look for the precise coverage language describing insurance limits. It have to actually nation whether or not protection, agreement, and research expenses are break away or covered inside your said limits. Some rules use language like every sum the insured shall grow to be legally obligated to pay for damages inclusive of expenses and expenses, indicating protection expenses matter in opposition to your limits. Better rules nation the organization pays damages on behalf of the insured and could protect any fit in opposition to the insured, suggesting protection is break away harm payments.

Occurrence-Based Versus Claims-Made Coverage

The coverage kind phase determines the essential shape of your insurance and has great implications on your long-time period protection. Malpractice rules are available in types: occurrence-primarily based totally and claims-made, and expertise the distinction is genuinely essential to heading off insurance gaps.

Occurrence-primarily based totally rules cowl any incident that takes place throughout your coverage duration irrespective of whilst a declare is surely filed. If you’ve got an occurrence-primarily based totally coverage lively in twenty twenty-4 and an incident happens in June twenty twenty-4, you`re blanketed even though the affected person does not report a lawsuit till twenty twenty-seven after you’ve got switched to a one-of-a-kind insurer or permit your coverage lapse. Your twenty twenty-4 occurrence-primarily based totally coverage nevertheless responds to that declare as it covers incidents that came about whilst the coverage became lively.

Claims-made rules simplest cowl claims surely filed throughout the coverage duration and simplest if the incident came about after your retroactive date. If you’ve got a claims-made coverage lively in twenty twenty-4 and an incident happens in June twenty twenty-4, you are simplest blanketed if the declare is filed earlier than your coverage expires and you are nevertheless insured. If the affected person waits till twenty twenty-seven to report a lawsuit, your twenty twenty-4 coverage does not cowl you until you’ve got maintained non-stop claims-made insurance and the incident came about after your retroactive date.

The first-rate print will explicitly country whether or not your coverage is occurrence-primarily based totally or claims-made. Claims-made guidelines consist of extra language approximately retroactive dates, prolonged reporting durations, and tail insurance. These provisions are essential for keeping non-stop safety during your profession. The retroactive date is the earliest date for which incidents are included, although the declare is filed at some stage in the modern coverage period. Extended reporting durations can help you file claims for a restricted time after your coverage expires, generally thirty to sixty days. Tail insurance, additionally known as prolonged reporting endorsement, offers indefinite claims reporting capacity after your coverage ends.

Understanding your coverage kind impacts main profession decisions. Leaving a claims-made coverage with out shopping tail insurance creates an insurance hole for all beyond incidents, leaving you uncovered to claims out of your complete profession as much as that point. Tail insurance generally prices a hundred fifty percentages to 3 hundred percentage of your annual top class as a one-time purchase. For coverage with a hundred greenback annual top class, tail insurance ought to price 3 hundred to 600 greenbacks whilst leaving.

Occurrence-primarily based totally guidelines price greater annually, generally twenty to thirty percentage better rates than equal claims-made insurance, however they put off the want for tail insurance and offer less complicated long-time period safety. Evaluating which coverage kind fits your profession plans calls for analyzing the first-rate print cautiously and thinking about your predicted profession trajectory.

Exclusions: What Your Policy Doesn`t Cover

The exclusions phase is arguably the maximum vital first-rate print on your complete coverage as it particularly lists situations, activities, and occasions that aren’t included irrespective of your insurance limits. Exclusions put off insurance for particular scenarios, and coverage groups don’t have any responsibility to shield or pay claims falling beneath exclusions.

Common exclusions in nursing malpractice guidelines consist of crook acts, sexual misconduct, acts accomplished even as beneath the have an effect on of medication or alcohol, incidents taking place out of doors your scope of practice, and offerings supplied without right licensure. These exclusions make feel and are general throughout maximum guidelines. However, many guidelines consist of extra exclusions that drastically restriction insurance in approaches nurses regularly does not anticipate.

Telehealth and digital care exclusions have emerge as more and more not unusual place and problematic. Many older rules written earlier than telehealth have become substantial exclude insurance for offerings furnished through smartphone, video, or digital communication. As nursing exercise more and more contains digital triage, far flung affected person monitoring, and video consultations, those exclusions create risky insurance gaps. The satisfactory print might also additionally kingdom insurance does now no longer observe to offerings furnished via digital method or expert recommendation given through smartphone or net communication.

Employment-associated claims are commonly excluded from expert legal responsibility rules. If a affected person sues you for discrimination, violation of privateness rights unrelated to scientific treatment, assault, or defamation, your malpractice coverage possibly won`t cowl those claims. These conditions require special coverage merchandise like standard legal responsibility insurance or employer’s practices legal responsibility coverage.

Business pastimes and industrial sports are excluded from maximum man or woman expert legal responsibility rules. If you use a facet enterprise as a nurse consultant, professional witness, prison nurse consultant, or personal obligation nurse, your widespread coverage might not cowl expert offerings furnished via your enterprise. The satisfactory print would possibly exclude insurance for offerings completed for reimbursement aside from as a worker or impartial contractor on your nursing capacity.

Some rules exclude insurance for incidents happening at the same time as operating in positive settings. Volunteer paintings, global nursing, paintings completed in states in which you are now no longer licensed, or offerings furnished in non-healthcare settings like camps, schools, or correctional centers can be excluded. Reading the exclusions phase cautiously famous whether or not your coverage covers all components of your real nursing exercise or when you have uninsured gaps.

Prior acts exclusions in claims-made rules put off insurance for incidents that took place earlier than your retroactive date. If you turn from one claims-made coverage to another, your new coverage might not cowl beyond incidents until you negotiate previous acts insurance and your new insurer is of the same opinion to a retroactive date matching your preceding non-stop insurance period.

Duties After Loss and Claim Reporting Requirements

The responsibilities after loss phase outlines your precise responsibilities if an incident happens that would bring about a declare or in case you`re notified of a real declare. Failing to conform to those necessities can void your insurance entirely, making this high-quality print phase definitely vital to recognize earlier than you want it.

Most guidelines require instant notification on your coverage organization as quickly as you emerge as privy to an incident that might fairly cause a declare. The high-quality print generally specifies you have to document inside a positive timeframe, which include as quickly as achievable or inside thirty days of turning into privy to a capacity declare. This requirement applies even though no formal lawsuit has been filed yet. If an affected person or member of the family threatens criminal action, expresses severe dissatisfaction with care, or an incident happens with clean capacity for harm, you have to document it on your insurer.

Delayed reporting can absolutely remove your insurance. If you wait months to document an incident after which the affected person documents a lawsuit, your insurer may also deny insurance due to the fact you violated the activate reporting requirement to your coverage high-quality print. Courts normally uphold those denials whilst coverage language virtually certain instant reporting responsibilities.

The high-quality print additionally calls for you to cooperate absolutely together along with your insurer’s research and protection of any declare. This consists of supplying entire and correct facts, attending depositions and courtroom docket proceedings, collaborating in agreement negotiations, and now no longer making any admissions of legal responsibility or settlements without the insurer’s consent. Language just like the insured shall now no longer voluntarily make any payment, anticipate any obligation, or incur any rate without the organization’s consent approach you can’t settle a declare in your personal even in case you assume it is the proper issue to do.

You generally can’t speak the declare publicly, with colleagues, or on social media without jeopardizing insurance. The high-quality print may also consist of confidentiality necessities mentioning the insured shall now no longer divulge facts approximately the declare besides as required via way of means of regulation or as important for protection. Posting approximately a lawsuit on Facebook or discussing it with coworkers should violate this provision and void your insurance.

Understanding those necessities earlier than an incident happens permits you to reply efficaciously with inside the vital hours and days following a capacity declare, maintaining your insurance and protection.

Definitions Section: The Foundation of Your Coverage

The definition phase is frequently skipped through policyholders however carries a number of the maximum vital pleasant print for your complete coverage. This phase defines key phrases used at some stage in the coverage, and those definitions decide the scope of your insurance. Terms that appear apparent in regular language have unique criminal meanings in coverage rules which could fluctuate out of your assumptions.

The definition of expert offerings determines what sports are absolutely included beneath your coverage. Some rules outline this extensively as any carrier supplied inside your nursing capacity, whilst others specially listing included offerings like affected person care, charting, remedy administration, and supervision. If your coverage defines expert offerings narrowly and also you offer care outdoor that definition, you could now no longer be included.

Insured men and women or whose insured sections outline precisely who has insurance beneath the coverage. Individual rules generally cowl most effective the named nurse, however a few consist of insurance for nursing college students you supervise or healthcare employees you rent in case you perform a small nursing business. Understanding whose and isn`t insured beneath your coverage prevents assumptions that others are covered while they are now no longer.

The definition of prevalence or declare determines what triggers insurance. An prevalence is generally described as an accident, consisting of non-stop or repeated publicity to considerably the identical trendy dangerous conditions, whilst a declare is a written call for damages or offerings of suit. These apparently technical definitions decide whether or not your coverage responds to unique situations.

Policy territory definitions specify in which insurance applies geographically. Most rules cowl expert offerings rendered with inside the United States, its territories, and possessions, however global nursing can be excluded. If you tour overseas for missionary nursing, global volunteer works, or take assignments in different countries, confirm your coverage territory consists of those locations.

The definition of physical harm and belongings harm determines what varieties of damage are included. Most nursing malpractice specializes in physical harm; however in case you harm affected person belongings whilst presenting care, belongings harm insurance might also additionally apply. Understanding those definitions clarifies your insurance scope.

Settlement and Consent Provisions

The agreement segment determines who has authority to settle claims towards you and beneath what circumstances. This exceptional print is vital as it impacts your cappotential to govern your expert recognition and the phrases beneath which instances are resolved.

Many guidelines consist of consent to settle provisions supplying you with the proper to refuse agreement of a declare. Language just like the organization shall now no longer settle any declare without the insured`s written consent way your insurer can not pressure you to simply accept an agreement you trust is unjust or that calls for admission of wrongdoing. This safety permits you to insist on protecting your nursing care in courtroom docket as opposed to settling to shop the coverage organization money.

However, consent to settle provisions normally consist of hammer clauses proscribing your refusal rights. A standard hammer clause states in case you refuse an inexpensive agreement advice from the insurer and the very last judgment exceeds the agreement provide, you are individually answerable for the distinction plus protection expenses after the agreement provide become refused. This creates economic stress to simply accept agreement guidelines even while you need to shield the case.

Some guidelines deliver the coverage organization entire agreement authority without requiring your consent. Language just like the organization can also additionally investigate, negotiate, and settle any declare because it deems suitable eliminates your manipulate over settlements. While this offers the insurer flexibility to remedy instances efficiently, it way you would possibly have settlements to your file which you opposed.

Reading the exceptional print on agreement provisions tells you whether or not you’ve got significant enter into how claims towards you’re resolved or if the coverage organization makes those selections unilaterally primarily based totally on economic considerations.

Subrogation and Recovery Rights

Subrogation clauses provide your coverage agency the proper to pursue restoration from 0.33 events that may also percentage duty for the damage to the patient. If your coverage agency can pay a declare in your behalf and believes some other birthday celebration contributed to the patient`s injury, the insurer can pursue that birthday celebration to get better the cash paid out.

The nice print generally states the insured shall cooperate with the agency in any subrogation movement and shall do not anything to prejudice the agency’s subrogation rights. This approach in case your insurer desires to sue the hospital, physician, or gadget producer to get better declare charges, you have to cooperate with that movement even supposing it creates expert awkwardness.

Understanding subrogation rights allows you count on capability headaches after claims are resolved, aleven though those provisions normally advantage you via way of means of permitting your insurer to get better charges that could lessen long-time period top rate impacts.

Expert Nurse Educator’s Insight

After reviewing hundreds of malpractice regulations at some point of my profession and counseling infinite nurses thru insurance issues, I’ve found out that the most important mistake nurses make is treating malpractice coverage as a commodity buy in place of spotting it because the criminal settlement defensive the whole lot they have labored for. I advocate each nurse agenda a devoted hour to study their whole malpractice coverage from begin to complete at the least once. Yes, the language is dense and criminal terminology may be confusing, however you may be surprised at what you discover.

Keep a notepad close by and write down each time period you do not apprehend, each exclusion that surprises you, and each phase that appears applicable on your precise exercise setting. Then touch your coverage agent or agency consultant and undergo your questions systematically till you apprehend precisely what you have. This one-hour funding may want to prevent tens of hundreds of bucks and years of strain in case you ever face a declare.

Additionally, I strongly inspire nurses to check their coverage yearly while renewal notices arrive in place of robotically renewing. Your nursing exercise evolves over time—you are taking on new roles, paintings in one-of-a-kind settings, or upload duties like precepting college students or telehealth consultations. Each alternate probably influences your insurance needs.

Your coverage from 3 years in the past might not appropriately defend your cutting-edge practice, and reviewing the great print yearly guarantees your insurance continues tempo together along with your profession evolution. Finally, by no means hesitate to invite questions on something to your coverage. Insurance representatives are obligated to give an explanation for insurance terms, and valid insurers welcome questions due to the fact they need you to apprehend what you`re buying. If an insurer makes you experience silly for asking designated questions on great print, it truly is a crimson flag suggesting you must discover an exceptional organization that values knowledgeable customers.

Red Flags in Policy Fine Print That Should Concern You

Overly Broad Exclusions

While all guidelines incorporate important exclusions, be cautious of guidelines with strangely wide exclusion language that might remove insurance for not unusual place nursing activities. Exclusions the use of indistinct terminology like every provider supplied out of doors conventional sanatorium settings or expert recommendation given informally create ambiguity that favors the coverage organization while denying claims. If exclusion language appears to doubtlessly embody big quantities of your real work, query whether or not the coverage appropriately protects you.

Restrictions on Independent Practice

Some guidelines consist of great print limiting insurance to offerings carried out beneath health practitioner supervision or inside institutional settings. For nurse practitioners, medical nurse specialists, and nurses operating in self-reliant roles, those regulations may want to remove insurance for impartial medical decision-making, that’s exactly while you maximum want protection.

Requiring Prior Authorization for Legal Defense

Some finances regulations consist of clauses requiring you to reap earlier authorization from the coverage agency earlier than hiring criminal illustration or incurring protection prices. This requirement can put off securing recommend and might deliver the insurer beside the point manipulate over your criminal protection strategy. Quality regulations offer on the spot protection without requiring earlier authorization.

Unclear Defense Cost Provisions

If the satisfactory print is ambiguous approximately whether or not protection prices are inside or further to insurance limits that is a main purple flag. The coverage has to absolutely kingdom how protection prices are handled. Vague language advantages the coverage agency and will imply you’ve got much less insurance than you think.

Extremely Low Coverage Limits for High-Risk Specialties

If you figure in vital care, emergency nursing, working room, exertions and delivery, or different high-chance specialties, insurance limits underneath 1,000,000 consistent with prevalence and 3 million mixtures can be inadequate. While better limits fee more, the satisfactory print has to provide enough safety given your chance exposure.

No License Defense Coverage

Policies that absolutely exclude license protection or administrative court cases go away you at risk of good sized out-of-pocket prices in case you face board of nursing investigations. This insurance has to both be protected or to be had as a low cost rider.

Making Your Policy Fine Print Work for You

Create a Personal Policy Summary

After analyzing your entire coverage, create a one-web page précis in simple language documenting your insurance limits, coverage type, key exclusions, reporting necessities, and agreement provisions. This reference sheet enables you recognize your insurance at a look and guarantees you observe coverage necessities if an incident occurs.

Compare Your Policy Against Your Actual Practice

List all of your cutting-edge nursing sports which includes paintings settings, populations served, supervision responsibilities, telehealth services, volunteer paintings, and any unique roles or certifications. Then overview your coverage nice print to verify every pastime is blanketed. Identify any gaps in which your exercise won’t be completely covered and deal with them thru endorsements or supplemental insurance.

Document Communications About Coverage

If your coverage agent or consultant makes verbal representations approximately insurance, request written affirmation and hold it together along with your coverage files. While the written coverage governs insurance, documentation of representations enables if disputes get up approximately what insurance become promised as opposed to what become delivered.

Review Changes at Renewal

Insurance corporations can alter coverage phrases at renewal with the aid of using issuing up to date coverage language or endorsements. Don`t anticipate your renewal is same in your preceding insurance. Read renewal files cautiously searching out adjustments in exclusions, limits, or phrases that would have an effect on your protection.

Ask Specific Hypothetical Questions

Pose precise eventualities in your coverage consultant primarily based totally to your real paintings and ask whether or not they might be blanketed. For example, ask if you’ll you be blanketed if I furnished remedy recommendation to a affected person thru video appointment or might I be blanketed if I volunteered at a fitness honest and a player claimed damage from my recommendation. Their solutions assist you recognize how the coverage applies to actual situations, aleven though constantly confirm solutions in opposition to the real coverage language.

Frequently Asked Questions About Malpractice Policy Fine Print

Should I buy occurrence-based or claims-made malpractice insurance?

Occurrence-primarily based totally insurance offers less complicated long-time period safety as it covers incidents that appear at some point of the coverage duration irrespective of whilst claims are filed, putting off the want for tail insurance whilst you convert jobs or retire. However, occurrence-primarily based totally guidelines fee twenty to thirty percentage greater yearly than claims-made insurance. Claims-made guidelines are to begin with much less costly however require buying tail insurance whilst leaving, which generally charges 100 fifty to 3 hundred percentage of your annual top class as a one-time expense.

For nurses early of their careers who can also additionally alternate jobs frequently, occurrence-primarily based totally insurance regularly offers higher cost through fending off a couple of tail insurance purchases. For nurses drawing near retirement or making plans to go away scientific exercise inside some years, claims-made insurance with a very last tail buy can be greater fee-effective. Consider your profession timeline and calculate the overall fee of every alternative together with cappotential tail insurance earlier than deciding.

What occurs if I transfer Coverage Corporation’s mid-profession with a claims-made coverage?

Switching claims-made guidelines creates a cappotential insurance hole for beyond incidents until you manage the transition correctly. You want both tail insurance out of your antique insurer to cowl beyond incidents or nostril insurance out of your new insurer supplying retroactive insurance returned in your unique non-stop insurance date. Tail insurance out of your departing insurer generally charges 100 fifty to 3 hundred percentage of your annual top class and offers indefinite reporting capacity for claims bobbing up from incidents at some point of your insurance duration.

Nose insurance out of your new insurer can be much less costly if they comply with in shape your preceding retroactive date, basically supplying non-stop claims-made insurance without gaps. Before switching insurers, get written fees for each tail insurance out of your modern insurer and nostril insurance with a previous acts retroactive date out of your potential new insurer. Compare overall charges and make certain no insurance gaps exist at some point of the transition.

Does my employer’s malpractice insurance cover me adequately or do I need my own policy?

Most healthcare employers offer expert legal responsibility insurance for employees, however enterprise insurance has great boundaries that non-public guidelines address. Employer guidelines cowl you most effective at the same time as operating inside your employment responsibilities and might not cowl paintings outdoor your job, volunteer sports, serving on expert boards, or professional witness testimony.

If you depart employment earlier than a declare is filed for an incident that happened at some point of employment, enterprise insurance might not reply in the event that they use claims-made guidelines without tail insurance for former employees. Employer insurance protects the organization`s pastimes first, and the enterprise’s legal professional represents the organization in place of you personally, developing ability conflicts in case your pastimes diverge out of your enterprise’s.

Personal malpractice coverage offers unbiased prison recommends representing totally your pastimes, covers sports outdoor employment, protects you after leaving jobs, and usually consists of license protection insurance that enterprise guidelines might not offer. Most nurse educators and expert groups suggest all nurses bring non-public malpractice coverage irrespective of enterprise insurance, specifically given annual rates of most effective 100 to 2 hundred bucks for a million according to prevalence and 3 million combination limits.

How do I realize if my coverage covers telehealth and digital nursing offerings?

Many malpractice guidelines written earlier than telehealth have become tremendous incorporate exclusions for offerings furnished electronically, thru telephone, or via net communication. Review your coverage’s exclusions segment cautiously seeking out language apart from digital care, digital offerings, telecommunications, or comparable terms. If exclusions exist for digital offerings, your telehealth paintings might not be protected. Contact your coverage enterprise to request a telehealth endorsement including this insurance, which usually expenses minimum extra premium.

Some insurers now encompass telehealth insurance mechanically in up to date guidelines, at the same time as others provide it as a non-compulsory rider. If you’re cutting-edge insurer might not upload telehealth insurance or expenses immoderate fees, don’t forget switching to an insurer focusing on current nursing practice. Given the everlasting growth of digital care in nursing practice, telehealth insurance is vital for present day nurses. Request written affirmation out of your insurer clarifying whether or not your particular digital care sports are protected beneathneath your cutting-edge coverage.

What should I do if I think an incident might turn into a claim but nothing has been filed yet?

Report ability claims in your coverage enterprise without delay even without formal felony action. Most guidelines require you to record incidents that might fairly cause claims as quickly as you grow to be aware about them. Reportable conditions encompass sufferers or households expressing extreme dissatisfaction, threats of felony action, good sized scientific headaches probably associated with your care, activities requiring sanatorium incident reviews regarding ability affected person harm, or conditions in which you’ve got any situation approximately a probable destiny declare. Your coverage`s responsibilities after loss segment specifies reporting necessities and timelines, commonly requiring word as quickly as practicable.

Early reporting protects your insurance with the aid of using making sure compliance with coverage phrases and permits your insurer to research even as proof is sparkling and witnesses are available. Insurance businesses decide upon early notification as it permits proactive chance control probably stopping formal claims. Reporting ability incidents would not growth your rates or have an effect on your expert report if no declare in the end materializes. Don’t await formal felony papers to record concerns. Document the incident thoroughly, record it in your coverage enterprise following their distinct process, and maintain copies of your record and all communications in your records.

Read More:

https://nurseseducator.com/didactic-and-dialectic-teaching-rationale-for-team-based-learning/

https://nurseseducator.com/high-fidelity-simulation-use-in-nursing-education/

First NCLEX Exam Center In Pakistan From Lahore (Mall of Lahore) to the Global Nursing

Categories of Journals: W, X, Y and Z Category Journal In Nursing Education

AI in Healthcare Content Creation: A Double-Edged Sword and Scary

Social Links:

https://www.facebook.com/nurseseducator/

https://www.instagram.com/nurseseducator/

https://www.pinterest.com/NursesEducator/

https://www.linkedin.com/company/nurseseducator/

https://www.linkedin.com/in/nurseseducator/

https://x.com/nurseseducator?t=-CkOdqgd2Ub_VO0JSGJ31Q&s=08

https://www.researchgate.net/profile/Afza-Lal-Din

https://scholar.google.com/citations?hl=en&user=F0XY9vQAAAAJ